GENREAL

Bossless Forever Review

Bossless Forever Review

In today’s gig economy, many individuals are seeking opportunities that promise financial freedom without the constraints of a traditional job. Bossless Forever claims to be one such opportunity. With mixed reviews across various platforms, it’s important to determine whether it’s a legitimate way to earn money or simply an overpriced scam. Here’s a detailed analysis based on several key criteria:

1. Price vs. Value

- Price: Bossless Forever is often criticized for its steep price tag, especially when compared to similar programs on the market.

- Value: Users report that the content is largely composed of generic information readily available online for free. This raises questions about the program’s value proposition relative to its cost.

2. Quality of Content

- Positives: Some users appreciate the structured approach and motivational elements. The modules are well-organized, making it easy for beginners to follow.

- Negatives: Many reviews suggest that the depth of the content does not justify the cost. The strategies are basic and lack advanced insights or unique perspectives that would benefit experienced entrepreneurs.

3. Earning Potential

- Legit Opportunity: A few participants claim to have made money using the strategies provided, though often with significant additional investment and effort.

- Overhyped Promises: Many users argue that the earning potential is exaggerated, with success stories being the exception rather than the norm.

4. Support and Community

- Support: Bossless Forever offers a support team and community forum, which some users find helpful for troubleshooting and networking.

- Community Engagement: However, engagement levels can be low, and responses may take time, which can hinder progress for those needing immediate assistance.

5. Transparency and Reputation

- Transparency: One major criticism is the lack of transparency about what’s included in the program before purchase. Potential buyers are often left relying on vague promises.

- Reputation: Online reviews are polarized. While some praise the program for kickstarting their entrepreneurial journeys, others warn against it as a costly mistake.

Conclusion

Bossless Forever presents itself as a gateway to financial independence, but whether it delivers on this promise is debatable. For potential buyers, it’s crucial to weigh the cost against the content quality and realistic earning potential. Given the mixed reviews, it might be wise to explore other options or seek additional user experiences before committing to this program. It could be beneficial for motivated beginners looking for initial guidance, but seasoned entrepreneurs might find it lacking in depth and value.

FAQs

1. Is Bossless Forever suitable for beginners?

Yes, Bossless Forever is designed with beginners in mind, featuring a structured approach and easy-to-understand modules that can help newcomers get started on their entrepreneurial journey.

2. What is the cost of joining the Bossless Forever program?

The program has been criticized for its high cost, although specific prices may vary. It’s important to evaluate whether the investment aligns with your personal goals and the potential value you might derive from it.

3. Can I expect immediate returns by following the program?

While a few participants have reported earnings, immediate returns are not guaranteed. Success often requires additional investment and a significant amount of effort.

4. How can I access support if I encounter difficulties during the program?

Bossless Forever provides a support team and a community forum where users can seek assistance. However, the response times can vary, which may delay immediate help.

5. Is there a refund policy if I am dissatisfied with the program?

The refund policy details are generally not transparent upfront, so it’s advisable to inquire directly with the service provider to understand your rights and options.

6. How can I verify the authenticity of success stories associated with Bossless Forever?

Given the polarized reviews, it’s beneficial to seek out multiple user experiences and perhaps connect with past participants directly, when possible, to get an accurate picture of the program’s success rate.

GENREAL

How to Provide Comfort for Your Dog Donning Dogs Clothes

The practice of dogs clothes has grown in popularity for practical reasons as well as aesthetic ones, including as keeping them warm in colder climes. Not all dogs, though, adopt clothing right away. Some people may find the encounter upsetting or uncomfortable. You can make your dog feel more at ease and even make them love wearing clothes if you take the proper approach. These are some practical methods for introducing your pet to the world of dog fashion.

1. Understand Your Dog’s Needs and Preferences

It’s critical to comprehend your dog’s character and comfort level before introducing apparel. While some dogs may be anxious, others are inherently more accepting of novel situations. Additionally, take into account elements such as:

- Breed:While short-haired breeds like Greyhounds might benefit from more insulation, dogs bred for colder regions, like Huskies, might not need it.

- Size and Fit: Ill-fitting dogs can cause discomfort or restrict movement, so always choose appropriately sized garments.

- Material: Soft, lightweight, and breathable fabrics are ideal, especially for first-timers.

2. Start with Small Accessories

Start simple if your dogs clothes has never worn clothing. To assist them adjust to the feeling of wearing something on their body, introduce accessories like a lightweight harness or bandana. You can gradually transition them to more heavier clothing once they feel at ease wearing these.

3. Choose the Right Garment

Selecting the right piece of clothing is crucial for your dogs clothes comfort. Here are some tips:

- Avoid Complex Designs: Start with simple garments like a basic sweater or T-shirt.

- Opt for Adjustable Clothing: Look for clothes with adjustable straps or closures to ensure a snug yet comfortable fit.

- Prioritize Safety: Avoid clothing with small buttons, zippers, or embellishments that could be chewed off and swallowed.

4. Introduce Clothing Gradually

Introducing your dog to clothing should be a gradual process. Follow these steps:

- Let Them Sniff: Allow your dog to sniff and inspect the clothing before attempting to put it on.

- Offer Treats: Use positive reinforcement by offering treats and praise as you bring the garment closer to them.

- Start Slowly: Place the clothing on your dog for a few seconds, then remove it. Gradually increase the duration over time.

- Monitor Their Reaction: Watch for signs of stress, such as excessive scratching, whining, or attempting to remove the clothing. If these occur, take a break and try again later.

5. Practice at Home First

Before venturing outdoors, let your dogs clothes at home in a familiar environment. This helps them associate the clothing with a safe and comfortable space.

6. Make It a Positive Experience

Associating clothing with positive experiences can significantly improve your dogs clothes acceptance. For instance:

-

Pair with Fun Activities: Dress your dog just before a walk or play session to create positive associations.

-

Reward Good Behavior: Use treats, verbal praise, and petting whenever your dog remains calm while wearing clothes.

7. Be Patient and Observant

Since each dog is unique, some can require more time to get used to wearing dogs clothes. The key is patience. Throughout the process, pay attention to your dog’s comfort level and body language. Consider whether clothing is really necessary or if there is a better option if your dog appears to be uncomfortable all the time.

8. Consider Seasonal Needs

Dogs’ tolerance for clothing can vary depending on the season. For instance:

-

Winter: Jackets or sweaters can help keep your dog warm during cold weather.

-

Summer: Lightweight, breathable shirts can protect against sunburn for dogs with short or light-colored fur.

-

Rainy Days: Waterproof coats can keep your dog dry and comfortable.

9. Watch for Signs of Discomfort

Even if your dog initially accepts clothing, it’s essential to monitor them for signs of discomfort, such as:

- Difficulty moving or walking

- Excessive panting or overheating

- Attempts to remove the clothing

If you notice any of these signs, remove the clothing immediately and reassess the fit or material.

10. Consult a Professional if Needed

See a professional dog trainer or behaviorist if you’re having trouble getting your dog to wear clothes. They can offer customized guidance and training methods based on your dog’s unique requirements.

11. Respect Your Dog’s Preferences

In the end, it’s acceptable if some dogs never like wearing clothing. When a dog is made to wear something they don’t enjoy, it can cause stress and behavioral problems. Your dog’s health should always come before convenience or style.

Conclusion

It takes time, compassion, and positive reinforcement to get your dog to feel at ease wearing clothing. You can help your dog feel more comfortable by being patient and attentive to their wants and preferences. Making sure your dog links clothing to good experiences, whether for warmth, protection, or style, will facilitate and enhance the transition for both of you.

FAQs

Q: How do I know if my dog needs clothes?

A: Dogs with short fur, small breeds, and older dogs may need clothing for warmth in colder weather. Assess your dog’s needs based on their breed, age, and environment.

Q: What materials are best for dog clothes?

A: Choose soft, breathable fabrics like cotton or fleece. Avoid materials that can cause irritation or overheating.

Q: How can I ensure the clothes fit properly?

A: Measure your dog’s chest, neck, and length before purchasing. Opt for adjustable garments to ensure a snug but comfortable fit.

Q: Is it safe for my dog to wear clothes all day?

A: No, it’s best to remove clothing periodically to allow your dog’s skin to breathe and prevent overheating or discomfort.

Q: What should I do if my dog dislikes wearing clothes?

A: If your dog shows persistent discomfort, respect their preferences and avoid forcing them to wear clothes. Try alternatives like blankets or heated pads for warmth.

GENREAL

Top 10 Most Ferocious Fighters in History and Their Legendary Battles

Fighting has always captivated the human spirit. From ancient duels on blood-soaked battlefields to strategic military campaigns that altered empires, the art of combat reveals much about our history and culture. Throughout the ages, certain ferocious fighters have become legends—not merely for their skills but for their incredible ferocity in battle. These warriors embodied courage and tenacity, leaving behind tales of valor that still inspire awe today.

What makes a fighter truly ferocious? Is it raw strength, cunning intelligence, or an unyielding will to win at any cost? The answers are as varied as the ferocious fighters themselves. Join us as we delve into the lives of ten extraordinary individuals whose prowess in warfare not only shaped history but also earned them a place among the most formidable foes ever known. Prepare to explore battles filled with drama, strategy, and sheer brutality—because these are stories worth telling!

Criteria for Determining Ferocity in Fighters

When discussing ferocious fighters, several key criteria come into play.

Courage is paramount. A truly fearsome warrior faces danger head-on, often without regard for personal safety.

Skill in combat also ranks high. Mastery of techniques and strategies can turn the tide in battle, showcasing a fighter’s prowess.

Resilience cannot be overlooked. The ability to withstand pain and adversity while maintaining focus is essential for any legendary fighter.

Moreover, leadership qualities matter significantly. Ferocious fighters inspire their troops, rallying them to fight with unmatched intensity against overwhelming odds.

Historical impact plays a role. A fighter’s legacy—how they shaped battles or even nations—often amplifies their reputation as one of history’s fiercest warriors. Each aspect contributes to the overall essence of what makes someone truly ferocious in the annals of fighting legends.

Genghis Khan and the Mongol Conquests

Genghis Khan, born as Temüjin, rose from humble beginnings to become the most feared conqueror in history. His ferocity was not just in his fighting skills but also in his strategic brilliance.

Under his leadership, the Mongol Empire expanded rapidly across Asia and into Europe. With unparalleled speed, Genghis led armies that often outmaneuvered larger forces.

His campaigns were marked by brutality; cities that resisted faced utter destruction. He understood psychology well, using terror as a weapon to instill fear and encourage surrender.

Moreover, the Mongols excelled at horseback warfare—an innovation that gave them an edge over their enemies. The famous cavalry charges became legendary for their effectiveness.

Genghis Khan’s legacy is complex; he unified diverse tribes under one banner while establishing trade routes that connected East and West. His influence shaped civilizations long after his death.

Spartacus and the Slave Revolt against Rome

Spartacus, a Thracian gladiator, became the face of rebellion against Rome’s oppressive regime. He transformed from a prisoner into a symbol of hope for countless slaves yearning for freedom.

In 73 BCE, he led an uprising that would shake the very foundations of Roman power. Armed with both courage and tactical genius, Spartacus rallied thousands around him. Together they escaped captivity and carved out their own path.

The revolt gained momentum as it swept through Italy. Battles erupted across the countryside as former slaves took up arms against their masters. Spartacus was not just fighting for his life; he was igniting the fire of resistance in others.

Despite facing formidable legions sent by Rome to quell the insurrection, Spartacus displayed remarkable prowess in battle. His strategies left Roman generals scrambling to maintain control over their empire’s unruly heartland. The fight wasn’t merely about survival; it was about dignity and autonomy in a world built on oppression.

Alexander the Great and His Conquest of Persia

Alexander the Great, a name that echoes through history. His audacious ambition led him to challenge the vast Persian Empire, one of the mightiest forces of his time.

In 334 BC, he crossed into Asia Minor with an army that was both loyal and fearless. The Battle of Granicus marked his first major victory against Persian satraps. With brilliant tactics, Alexander showcased his prowess on the battlefield.

His march continued through cities like Tyre and Gaza, where he met fierce resistance but never wavered. Each conquest added to his legendary status; each victory fueled his insatiable hunger for more territory.

The Battle of Gaugamela in 331 BC became a defining moment. Facing Darius III’s massive forces, Alexander’s strategic genius shone brightly amidst chaos. His cavalry flanked and shattered enemy lines, leading to a decisive triumph.

This relentless pursuit transformed him into one of history’s most ferocious fighters—an enduring symbol of military brilliance and ambition.

Joan of Arc and the Hundred Years’ War

Joan of Arc stands as a symbol of courage amidst the chaos of the Hundred Years’ War. A peasant girl from Domrémy, she claimed divine guidance to lead France against English occupation. Her conviction ignited hope in a nation teetering on despair.

In 1429, Joan convinced Charles VII to allow her to accompany his forces. Dressed in armor, she inspired troops with her fearless presence. The Siege of Orléans became a turning point; under her leadership, French forces reclaimed the city and shifted momentum toward victory.

Despite her achievements, fate took a cruel turn. Captured by Burgundian allies and handed over to the English, Joan faced trial for heresy. She was ultimately executed at just 19 years old but left an indelible mark on history as one of its most ferocious fighters—a true warrior for freedom who continues to inspire generations today.

Miyamoto Musashi and His Duel with Sasaki Kojiro

Miyamoto Musashi remains a towering figure in the realm of martial arts. His duel with Sasaki Kojiro is legendary, often regarded as one of the most intense confrontations in history.

The battle took place on Ganryu Island in 1612. Musashi arrived late, a psychological tactic that unsettled his opponent. Kojiro wielded a long sword, known for its reach and power.

Musashi opted for an unconventional approach, using a wooden oar as his weapon. This unexpected choice showcased not only his skill but also his adaptability.

As they clashed, it became clear that precision and strategy outweighed sheer strength. The duel ended with Musashi delivering a decisive blow, cementing his legacy as one of Japan’s greatest swordsmen.

This encounter was more than just a fight; it symbolized the spirit of bushido—the way of the warrior—highlighting honor and mastery over one’s craft.

Napoleon Bonaparte and His Military Campaigns

Napoleon Bonaparte was a master strategist and one of history’s most ferocious fighters. Rising to prominence during the French Revolution, he quickly established himself as a formidable leader.

His military campaigns across Europe showcased his tactical genius. He employed innovative techniques that left opponents bewildered. The speed and precision of his maneuvers often determined battles before they truly began.

The Italian Campaign is particularly noteworthy. Napoleon’s forces defeated larger armies through clever use of terrain and rapid movement. His ability to inspire troops was equally impressive, fostering unwavering loyalty among soldiers.

At Waterloo, however, circumstances shifted dramatically. A coalition of European powers united against him, ultimately leading to his defeat in 1815. Yet even in adversity, Napoleon’s legacy as a ferocious fighter endures in the annals of military history.

Ronda

Ronda Rousey is a name that resonates deeply in the world of mixed martial arts and beyond. Known for her incredible skill set, she dominated the sport during her reign as UFC champion. Her ferocity wasn’t just in her physical prowess but also in her mental approach to competition.

Rousey’s iconic judo throws and armbar submissions became legendary, showcasing an unmatched intensity that left opponents trembling before they stepped onto the mat. Her rise to fame transformed women’s sports, proving that women can be just as fierce and formidable as their male counterparts.

Her battles inside the octagon were not merely about winning; they represented a cultural shift toward accepting female fighters on equal footing with men. Rousey’s impact extends past victories; she inspired countless individuals to pursue their passions relentlessly.

Ferocious fighters like these have shaped history through their unparalleled courage and determination. Each has carved out a legacy filled with epic battles, heroic struggles, and stories that continue to inspire generations today.

GENREAL

Spiral Staircase Design Ideas: How to Make a Statement in Your Home

Are you looking to elevate your home’s aesthetic while maximizing space? Spiral staircases might just be the answer. These elegant structures not only save room but also serve as stunning focal points in any interior design. Imagine a sleek spiral staircase winding up to a cozy loft or an artistic centerpiece that draws the eye and sparks conversation. Whether you’re building from scratch or renovating, adding a spiral staircase can transform your living space into something extraordinary. Let’s explore why these unique designs are becoming increasingly popular and how you can incorporate them stylishly into your home!

The Benefits of Adding a Spiral Staircase to Your Home

Adding a spiral staircase to your home brings an undeniable charm and character. Its unique design can serve as a stunning focal point in any room, drawing the eye upward.

Space-saving is another major benefit. Unlike traditional staircases, spiral designs occupy minimal floor area while providing access to upper levels. This efficiency makes them ideal for compact living spaces.

Aesthetic versatility is key too; whether your home leans toward modern elegance or rustic warmth, there’s a spiral staircase style that fits perfectly.

Moreover, these staircases can enhance the overall value of your property. Potential buyers often see them as luxurious features that elevate the home’s appeal.

They encourage creativity in interior design by offering opportunities for personalization through materials and finishes—wood, metal, glass—you name it!

Factors to Consider Before Installing a Spiral Staircase

Before installing a spiral staircase, you need to evaluate your space. Measure the area where you intend to place it. Ensure there is enough room for both the staircase and safe movement around it.

Consider your home’s layout. A spiral staircase works best in open spaces or as a focal point. Think about how it will connect different levels without obstructing flow.

Safety is another crucial factor. Check local building codes regarding dimensions and railings. The height of each step should be comfortable for users.

Also, reflect on aesthetics. Choose a design that complements your existing decor style—be it modern, rustic, or traditional.

Think about usage frequency. If it’s just for occasional access to an attic or loft, that may influence your choice of materials and overall design preferences.

Different Styles and Materials of Spiral Staircases

Spiral staircases come in various styles, each offering a unique aesthetic to your home. The classic metal spiral is popular for its industrial charm and durability. It often features sleek lines that can fit seamlessly into modern decor.

Wooden spiral staircases exude warmth and elegance. They provide a rustic or traditional touch, perfect for cozy interiors. Different wood types allow you to customize the finish according to your taste.

For a contemporary look, glass spirals are becoming increasingly trendy. They create an illusion of space while allowing natural light to flow through your home.

Other materials like concrete or wrought iron add character as well. Concrete offers sturdiness, while wrought iron brings intricate designs that make a striking visual impact.

Choosing the right style and material enhances not just functionality but also elevates the overall design of your living environment.

Creative Ways to Incorporate a Spiral Staircase in Your Home Design

A spiral staircase can be a stunning focal point in any room. Consider placing one in a corner nook to create an intimate reading area. This design not only saves space but also adds character.

Incorporate a spiral staircase near large windows for breathtaking views. The natural light enhances the beauty of the materials used, whether they’re wood, metal, or glass.

For outdoor spaces, think about extending your living area with an exterior spiral staircase leading to a rooftop terrace or garden. This invites fresh air and creates additional entertainment options.

Another innovative idea is using open shelving beneath the stairs for extra storage. It maximizes your space while showcasing books or decorative items creatively.

Consider integrating lighting into the design of your spiral staircase. LED strips along the steps add safety while creating an alluring ambiance at night.

Maintenance and Safety Tips for Spiral Staircases

Maintaining a spiral staircase is crucial for both aesthetics and safety. Regular cleaning helps prevent dirt buildup, which can make surfaces slippery. Use a damp cloth to wipe down wood or metal finishes.

Check the structure periodically for loose bolts or screws. Tightening these ensures stability and security when using the stairs.

Consider applying a non-slip coating to treads if you have concerns about slipping, especially in high-traffic areas. This simple addition can enhance safety significantly.

Lighting is another important factor; well-lit staircases reduce accidents at night. Install lights strategically along the railing or on wall fixtures nearby.

Educate family members about proper usage. Encourage them to hold onto railings while ascending or descending, promoting safe habits from an early age.

Conclusion: Elevate Your Home with a Unique Spiral Staircase Design

A spiral staircase can be a captivating focal point in any home. Its graceful curves draw the eye and create an inviting atmosphere.

When you choose the right design, it enhances both aesthetics and functionality. The unique shape allows for creative use of space, making even small areas feel larger.

Consider how materials like wood, metal, or glass can reflect your personal style. Each option brings its own character to your home’s interior.

Lighting plays a crucial role too. Accentuating a spiral staircase with thoughtful illumination transforms it into an art piece by night.

Adding one is more than just an architectural choice; it’s about creating memories as family and friends gather around this stunning feature.

FAQs

Adding a spiral staircase to your home can raise many questions. Here are some of the most common inquiries about these stylish features.

What is a spiral staircase made of?

Spiral staircases can be constructed from various materials, including wood, metal, and glass. Each material offers its own aesthetic appeal and durability.

How much space do I need for a spiral staircase?

While one of the advantages of a spiral staircase is that it requires less floor space than traditional stairs, you still need sufficient height clearance above and below. Measure your available area carefully before installation.

Are spiral staircases safe?

Yes, when designed and installed correctly, they can be very safe. It’s essential to ensure proper railings are in place and that the steps have non-slip surfaces to enhance safety.

Can I customize my spiral staircase design?

Absolutely! Many manufacturers offer customizable options regarding size, shape, color, and materials so you can find the perfect match for your home’s decor.

Do I need permits to install a spiral staircase?

It often depends on local building codes. Always check with your local authorities or consult with professionals before proceeding with any construction projects.

With these insights into spiral staircases at hand, you’re now better equipped to make an informed decision about incorporating this striking element into your home design.

-

HOME10 months ago

HOME10 months agoTarget Trends: What’s Hot in Stores Right Now?

-

BUSINESS11 months ago

BUSINESS11 months agoCustomer Satisfaction: Definition and Importance

-

HOME10 months ago

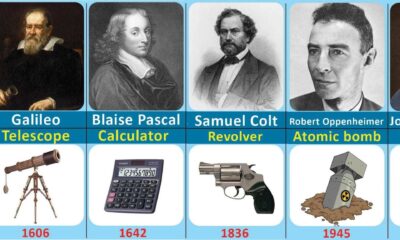

HOME10 months agoFrom Ideas to Innovations: How Inventors Change Our World

-

HOME5 months ago

HOME5 months ago300 Types of Flowers with Names from A to Z (and Pictures)

-

HEALTH10 months ago

HEALTH10 months agoThe Truth About Vasectomies: Myths, Facts, and Everything In Between

-

ENTERTAINMENT10 months ago

ENTERTAINMENT10 months agoFrom Isolation to Community: Strategies for Connecting with Readers

-

HEALTH10 months ago

HEALTH10 months agoRevitalize Your Waistline: 7 Delicious Flat Stomach Detox Water Recipes for Weight Loss

-

TECH9 months ago

TECH9 months agoThe Risks of Disconnecting Your AC Compressor: A Comprehensive Guide