HEALTH

Bridging the Gap: Understanding Health Equity and Its Importance

Imagine a world where everyone has the same access to healthcare, regardless of their background or circumstances. A place where your zip code doesn’t determine your health outcomes, and every individual can lead a healthy life without barriers. This vision is at the heart of health equity—a critical concept that seeks to address disparities in healthcare access and quality.

In today’s society, we often see stark differences in health outcomes among various communities. These discrepancies aren’t just numbers; they represent real lives affected by systemic issues. Understanding what health equity means and why it matters is crucial for creating a fairer landscape for all individuals.

Join us as we explore the multifaceted realm of health equity, uncovering its importance, identifying contributing factors to disparity, and discussing actionable strategies for change. Together, we can bridge the gap toward achieving true equality in health care access!

What is Health Equity?

Health equity refers to the principle of ensuring that everyone has a fair opportunity to attain their highest level of health. It goes beyond simply providing healthcare services; it addresses the underlying social, economic, and environmental factors that influence health outcomes.

At its core, health equity recognizes that not all individuals start from the same place. Factors such as race, income, education level, and geographic location can create significant barriers to accessing quality care.

This concept emphasizes justice in healthcare systems by aiming to eliminate these disparities. Achieving health equity means creating conditions where every person can thrive without facing obstacles due to their circumstances.

It’s about fostering an inclusive environment where equitable resources are distributed based on need rather than privilege. Understanding this definition is essential for anyone invested in making meaningful changes in our healthcare landscape.

Why is Health Equity Important?

Health equity is crucial because it ensures that everyone has the opportunity to attain their highest level of health. When barriers are removed, communities thrive.

Disparities in healthcare access lead to unequal outcomes. These imbalances can perpetuate cycles of poverty and poor health. Vulnerable groups often bear the brunt, suffering from preventable diseases at higher rates.

Moreover, achieving health equity fosters a sense of community resilience. When individuals feel supported and empowered, they are more likely to contribute positively to society. This collective well-being benefits everyone.

Promoting health equity also drives economic growth. A healthier population means reduced healthcare costs and increased productivity. Investment in equitable systems pays off for all stakeholders involved.

In essence, prioritizing health equity creates a fairer society where every individual has the chance to thrive physically and mentally regardless of their background or circumstances.

Factors That Contribute to Health Disparities

Health disparities arise from a complex web of factors. Socioeconomic status plays a pivotal role. Individuals with lower income often face barriers to quality healthcare, healthy food, and safe living conditions.

Geographic location is another significant factor. Rural areas frequently lack access to medical facilities and specialists compared to urban centers.

Cultural influences also contribute. Language barriers can make it difficult for patients to communicate their needs effectively, leading to misunderstandings and inadequate care.

Additionally, systemic issues like discrimination in healthcare settings exacerbate these disparities. Marginalized communities may experience bias that affects the quality of their treatment.

Education levels impact health literacy as well. Those with less education might struggle to navigate the healthcare system or understand vital information regarding wellness practices and preventive measures.

These intertwined factors create challenges that demand urgent attention and action within our society’s approach toward health equity.

The Impact of Inequality on Healthcare Access

Inequality in healthcare access is a pressing issue that affects millions. When resources are unevenly distributed, vulnerable populations often bear the brunt. This disparity can lead to significant gaps in treatment and preventive care.

People living in low-income areas may struggle to find nearby clinics or hospitals. Limited transportation options further complicate their ability to seek care. For many, skipping appointments becomes a common choice due to these barriers.

Cultural factors also play a role. Language differences can hinder communication between patients and providers, resulting in misunderstandings about health needs.

Additionally, those without insurance face exorbitant costs for medical services. These financial constraints discourage individuals from seeking necessary treatments, leading to worsening health outcomes over time.

Addressing these inequalities requires targeted efforts from policymakers and community organizations alike. Only through collective action can we hope to create equitable pathways for all individuals seeking healthcare services.

Strategies for Achieving Health Equity

Achieving health equity requires a multi-faceted approach. First, policy changes can play a crucial role. Implementing laws that promote access to healthcare for underserved populations ensures everyone gets the care they need.

Community engagement is another vital strategy. Local organizations can bridge gaps by providing education and resources tailored to specific community needs.

Training healthcare providers on cultural competency fosters understanding and improves patient interactions. When providers recognize unique barriers faced by different groups, they can offer better support.

Data collection is essential for identifying disparities. By analyzing health outcomes across demographics, stakeholders can target interventions effectively.

Fostering partnerships between public and private sectors amplifies efforts toward equitable health solutions. Collaboration brings together diverse resources and expertise that benefit all communities.

HEALTH

The Importance of Professional Help in Homicide Cleanup Situations

When tragedy strikes, the aftermath can be overwhelming. Homicide scenes are heartbreaking and chaotic. The emotional toll on families is immense, leaving them grappling with shock and grief. Yet, amidst this turmoil lies another daunting task: homicide cleanup.

Cleaning up after such a devastating event goes beyond mere mess removal; it involves addressing hazardous materials and potential health risks. This isn’t just about restoring a space—it’s about healing for those affected. Understanding the importance of professional help in these situations is crucial not only for safety but also for dignity and respect during an incredibly painful time.

Let’s explore why turning to experts in homicide cleanup is essential when faced with one of life’s most challenging circumstances.

The Dangers of Cleaning Up After a Homicide

Cleaning up after a homicide is an incredibly dangerous task. The presence of biohazards, such as blood and bodily fluids, poses significant health risks. These substances can harbor pathogens that may lead to serious infections or diseases.

Beyond physical dangers, the emotional toll cannot be underestimated. Witnessing the aftermath of violence can be traumatic for anyone involved in the cleanup process. This experience often triggers intense feelings of grief and fear.

Improper cleaning methods can also exacerbate hazards. Many individuals lack knowledge about safe disposal procedures for hazardous materials. As a result, they may unintentionally expose themselves or others to harmful contaminants.

Additionally, there are legal implications tied to this type of cleanup. Failing to follow regulations could lead to serious consequences for those attempting it on their own. Engaging with professionals ensures compliance with local laws while prioritizing safety at all levels.

Why Professional Help is Necessary

Cleaning up after a homicide is not something the average person should handle. The risks involved go far beyond emotional distress. Blood and bodily fluids can carry infectious diseases, posing serious health hazards.

Without proper training, individuals may overlook critical safety protocols. This could lead to contamination or exposure to harmful pathogens.

Professionals in homicide cleanup are equipped with the knowledge necessary for thorough decontamination. They follow strict guidelines to ensure that all biohazards are effectively removed.

Moreover, these experts work quickly and efficiently while respecting the sensitive nature of the situation. Their approach allows families to begin healing without added stress from cleanup tasks.

When it comes to such traumatic events, seeking professional help isn’t just advisable; it’s essential for both physical safety and emotional well-being.

Specialized Training and Equipment

Professional homicide cleanup teams undergo extensive specialized training. This preparation is crucial for handling hazardous materials safely and effectively.

They learn about biohazard protocols, infection control, and the proper disposal of contaminated items. These skills ensure that they can tackle even the most challenging situations without putting themselves or others at risk.

Moreover, these professionals use advanced equipment designed specifically for crime scene cleanup. From industrial-strength disinfectants to state-of-the-art protective gear, every tool plays a vital role in restoring safety to an environment tainted by trauma.

The knowledge gained through their training enables them to identify potential health risks quickly. Their expertise allows them not only to clean but also to decontaminate spaces thoroughly—making them safe once again for families and communities.

Compassion and Understanding for Victims’ Families

Homicide impacts families in profound ways. The aftermath of such tragedy leaves loved ones grappling with grief, confusion, and intense emotional pain.

When cleanup is necessary, compassion becomes vital. Professionals recognize the sensitivity involved in these situations. They approach each job with respect for the victims and their families.

Understanding goes beyond just cleaning up physical remnants; it involves acknowledging the heartache endured by those left behind. Compassionate service means being there not only as technicians but also as a source of support during an incredibly difficult time.

Every family has its story. Each person affected deserves care that respects their unique journey through loss. This human element makes professional help essential in homicide cleanup, ensuring that dignity remains intact amidst devastation.

Offering a helping hand while respecting boundaries can make all the difference for grieving families struggling to navigate their new reality after such a traumatic event.

Legal and Ethical Considerations

Homicide cleanup involves more than just physical labor. It raises significant legal and ethical considerations that must be addressed.

First, there are strict regulations governing biohazard disposal. Cleaning up crime scenes without following these laws can lead to serious penalties. Professionals trained in homicide cleanup understand these requirements thoroughly.

Ethically, the dignity of victims and their families is paramount. Sensitivity during such traumatic times cannot be overstated. Cleanup crews should approach each situation with respect and compassion, ensuring they do not add to the family’s distress.

Confidentiality is also crucial. Information about a case should remain private, safeguarding the affected individuals’ rights while adhering to local laws.

Navigating these complexities requires expertise beyond basic cleaning skills. Relying on professionals ensures compliance with all relevant guidelines while prioritizing empathy for those impacted by tragedy.

Conclusion

Homicide cleanup is an intensely challenging and sensitive task. It goes beyond physical cleaning; it involves managing trauma and emotions.

The impact on victims’ families can be profound, adding layers to an already devastating situation. Understanding this human aspect is essential for those involved.

Choosing professional help ensures that the cleanup is handled safely and respectfully. Trained experts bring not only skills but also compassion to a heart-wrenching scenario.

When faced with such tragedies, trusting professionals can alleviate some of the burdens. Their expertise allows families to focus on healing rather than dealing with aftermath details.

In these moments of crisis, prioritizing emotional well-being along with safety makes all the difference. It’s about creating space for recovery while addressing practical needs efficiently.

FAQs

When it comes to homicide cleanup, many questions arise. Here are some of the most common inquiries and their answers.

What is homicide cleanup?

Homicide cleanup refers to the professional cleaning process that occurs after a violent death, such as murder. This service ensures that all biohazardous materials are safely removed and proper sanitation procedures are followed.

Why should I hire professionals for homicide cleanup?

Professionals have the training and equipment necessary to handle hazardous materials safely. They also understand the emotional toll on families and approach each situation with compassion and respect.

Is it safe for non-professionals to clean up after a homicide?

No, attempting to clean up without proper training can expose individuals to serious health risks due to bloodborne pathogens or other contaminants present at crime scenes.

How long does the homicide cleanup process take?

The duration depends on various factors, including the size of the area affected and severity of contamination. Professional services typically aim for efficiency while ensuring thoroughness in their work.

Are there legal requirements related to homicide cleanup?

Yes, many regions have regulations regarding how crime scenes must be handled. Professionals ensure compliance with these laws during their work processes.

Can family members be involved in the cleanup process?

While it’s understandable that family members may want closure by participating, it’s best left to trained professionals who can manage both safety concerns and emotional sensitivity effectively.

What happens if I don’t get professional help after a homicide?

Neglecting professional assistance could lead not only to health risks but also potential legal repercussions due to improper handling of biohazards. It’s crucial for everyone’s well-being—including mental health—to seek out expertise in these traumatic situations.

HEALTH

DIY Cream Cleanser Recipes: Create Your Own Luxurious Skincare Products at Home

Are you tired of the endless search for the perfect cleanser? One that’s gentle on your skin, yet effective at removing dirt and impurities? Look no further! DIY cream cleanser are not only easy to make but also give you complete control over what goes onto your skin. Imagine whipping up a luxurious skincare product right in your kitchen. It’s empowering, fun, and oh-so-rewarding!

Creating your own cream cleanser allows you to tailor it specifically to your skincare needs. Plus, there’s something incredibly satisfying about crafting beauty products from natural ingredients. Say goodbye to harsh chemicals found in store-bought options and hello to nourishing alternatives that pamper your skin. Ready to dive into the world of homemade skincare? Let’s explore everything you need to know about making delightful cream cleansers at home!

Benefits of Making Your Own Skincare Products

Creating your own skincare products offers a sense of empowerment. You become the master of your routine, choosing exactly what goes onto your skin. This level of control means you can avoid harmful additives and irritating chemicals often found in commercial options.

Additionally, DIY skincare is budget-friendly. With a few simple ingredients, you can make luxurious creams that rival high-end brands without breaking the bank. Your wallet will thank you.

Customization is another significant perk. Each person’s skin has unique needs; making your own cream cleanser allows you to tailor it with specific oils or extracts that cater to yours.

Moreover, there’s something deeply satisfying about crafting products from scratch. The process itself can be therapeutic and enjoyable, turning self-care into an engaging ritual rather than just another chore on your list.

Using fresh ingredients ensures you’re applying nourishing elements directly from nature—no preservatives necessary!

Essential Ingredients for Cream Cleansers

When crafting your own cream cleanser, the right ingredients make all the difference. Start with a base oil like jojoba or almond oil. These oils mimic your skin’s natural sebum and provide hydration without clogging pores.

Next up is an emulsifier, essential for blending oil and water smoothly. Beeswax or candelilla wax works wonders in this role, giving your cleanser that creamy consistency you desire.

Additives like honey can enhance moisture levels while offering antibacterial properties. For a soothing touch, consider incorporating aloe vera gel; it’s known for its calming effects on irritated skin.

Essential oils are another great addition, providing both fragrance and benefits tailored to your needs—lavender is perfect for relaxation, while tea tree oil tackles blemishes effectively. By carefully selecting these key components, you can create a luxurious cream cleanser that’s as effective as it is delightful to use.

Easy and Effective DIY Cream Cleanser Recipes

Crafting your own cream cleanser at home is both simple and rewarding. One popular recipe involves blending ½ cup of coconut oil with ¼ cup of shea butter. Melt them together, then mix in five drops of lavender essential oil for a calming scent.

For an exfoliating twist, try combining ½ cup of plain yogurt with one tablespoon of honey and a teaspoon of finely ground oatmeal. This creamy blend not only cleanses but also gently scrubs away dead skin cells.

If you prefer something more refreshing, mix ¼ cup of aloe vera gel with two tablespoons of olive oil and the juice from half a lemon. This invigorating formula hydrates while removing impurities.

Each recipe is customizable, allowing you to experiment until you find your perfect match. Your skin will thank you for these natural alternatives that are free from harsh chemicals!

Customizing Your Cream Cleanser for Your Skin Type

Customizing your cream cleanser can make all the difference for your skin. Different skin types require unique care, so it’s essential to tailor your formula.

For dry skin, incorporate hydrating ingredients like honey or avocado oil. These natural moisturizers will help nourish and soothe while cleaning away impurities.

If you have oily or acne-prone skin, consider adding tea tree oil or witch hazel. Both offer antibacterial properties that help control excess oil without stripping the skin’s natural barrier.

Sensitive skin benefits from chamomile or aloe vera extracts. These calming agents reduce irritation and promote a gentle cleansing experience.

Combination skin might need a balanced approach. Blend nourishing oils with lighter ingredients like jojoba to hydrate without clogging pores.

Experimenting with these additions allows you to create a cream cleanser that’s just right for you!

Tips for Storing and Using Homemade Skincare Products

Storing your homemade skincare products properly is crucial for maintaining their freshness and effectiveness. Always use clean, airtight containers to prevent contamination. Glass jars or bottles are ideal as they don’t interact with the ingredients.

Label each product with its name and date of creation. This helps you track how long it has been stored, ensuring you use them while they’re still potent.

Keep your cream cleansers in a cool, dark place away from direct sunlight. Heat and light can degrade natural ingredients, reducing their efficacy over time.

When using your DIY cleanser, always apply it with clean hands or a spatula to avoid introducing bacteria. A little goes a long way—start with a small amount and adjust based on your skin’s needs.

Remember to patch-test any new formula on a small area of skin before full application to ensure compatibility without irritation.

Conclusion: Say Goodbye to Store-Bought Cleansers and Hello to Natural, Nourishing Skincare

Making your own cream cleanser is not only a fun and creative endeavor, but it also allows you to take control of what goes on your skin. With the right ingredients, you can tailor each recipe to meet your unique skincare needs. Say farewell to harsh chemicals found in many store-bought options and embrace the gentle, nourishing qualities of natural ingredients.

Creating these luxurious products at home empowers you to experiment with scents, textures, and benefits that suit your preferences. Whether you’re looking for hydration, exfoliation or soothing properties, DIY cream cleansers can be customized just for you.

Plus, it’s an eco-friendly choice that reduces plastic waste from commercial packaging. By opting for homemade solutions, you’re not just caring for your skin; you’re also making a positive impact on the environment.

So gather those essential ingredients and start crafting your own personal skincare line today! Enjoy the process as much as the results—your skin will thank you for it by glowing with health and radiance.

HEALTH

Maximize Your Workout: The Ultimate Rucking Calorie Calculator Guide

But how do you know just how many calories you’re torching during those ruck sessions? That’s where the rucking calorie calculator comes in. By understanding its importance and learning how to use it effectively, you’ll be well on your way to maximizing every step you take. Let’s dive deeper into what makes rucking so beneficial and discover the secrets behind calculating those all-important calories burned!

What is Rucking?

Rucking calorie calculator is a workout that combines walking or hiking with the added challenge of carrying weight on your back. Originating from military training, this exercise builds strength and endurance while improving cardiovascular fitness.

The beauty of rucking lies in its simplicity. All you need is a sturdy backpack and some weights—whether it’s dumbbells, sandbags, or even water bottles. The load adds resistance, intensifying your workout without requiring any special equipment.

You can customize your ruck to suit your fitness level and goals. Start light if you’re new to it, then gradually increase the weight as you build confidence and strength. It’s an efficient way to engage multiple muscle groups while enjoying the great outdoors or exploring urban landscapes.

Rucking isn’t just about physical benefits; it also offers mental advantages by providing time for reflection as you move through different environments.

Benefits of Rucking Workouts

Rucking calorie calculator workouts offer a unique blend of strength training and cardio. When you strap on a weighted backpack, your body engages multiple muscle groups, enhancing overall endurance.

The added weight increases calorie burn compared to regular walking or jogging. This makes rucking an efficient way to shed pounds while also building muscle in the legs, core, and back.

Additionally, rucking calorie calculator can improve posture. Carrying weight encourages alignment in the spine and engages stabilizing muscles that often get neglected during traditional exercise routines.

Another benefit is its accessibility. You don’t need a gym membership or fancy equipment; just grab a sturdy pack and hit the trail or pavement.

Rucking has mental health perks too. The rhythmic motion combined with being outdoors can reduce stress levels and enhance mood—making it not just a workout but also a therapeutic escape from daily life challenges.

How Many Calories Can You Burn Rucking?

The number of calories burned during rucking calorie calculator can vary widely based on several factors. On average, a person may burn between 400 to 700 calories per hour while rucking. This range depends on weight, pace, and terrain.

Heavier individuals tend to burn more calories because they have to exert more effort carrying the added load. Likewise, walking uphill or traversing rugged paths increases calorie expenditure significantly compared to flat ground.

Your pace plays a crucial role too. A brisk walk with a loaded backpack elevates your heart rate and boosts caloric burn. Keeping an eye on these elements will help you maximize your workout’s effectiveness.

Using tools like the Rucking Calorie Calculator can provide personalized estimates tailored to your specific conditions and goals. Different configurations mean different results; thus, understanding this variability is essential for anyone looking to enhance their fitness journey through rucking.

Factors That Affect Calorie Burning During Rucking

Several factors influence calorie burning during rucking. One major element is your body weight. Heavier individuals tend to burn more calories simply because they exert more effort.

The intensity of your ruck also matters. A brisk pace or challenging terrain will increase the number of calories you expend compared to a leisurely stroll on flat ground.

Carrying extra weight in your backpack contributes significantly as well. The heavier the load, the harder your body works, leading to higher calorie consumption.

Weather conditions can’t be overlooked either. Hotter temperatures may elevate heart rates and metabolism, while cold weather might demand extra energy for thermoregulation.

Fitness level plays a role; seasoned athletes often have efficient systems that may not require as many calories compared to beginners tackling their first rucks who might burn more due to increased effort and adaptation challenges.

How to Use a Rucking Calorie Calculator

Using a rucking calorie calculator is straightforward and beneficial. Start by gathering essential information about your workout.

First, input your weight. This helps determine the calories burned relative to body mass.

Next, enter the duration of your rucking calorie calculator session. The longer you walk with that weighted pack, the more calories you’ll burn.

Don’t forget to include the weight of your backpack. The added resistance significantly impacts calorie expenditure.

Some calculators may ask for terrain type—whether it’s flat or hilly—as this can alter results too.

After plugging in these details, hit calculate and watch as it estimates how many calories you’ve torched during your ruck. This insight allows you to tailor future workouts effectively.

Tips for Maximizing Your Rucking Workout

To get the most out of your rucking calorie calculator workout, start by choosing the right weight. Aim for 10-20% of your body weight. This range helps you build strength without risking injury.

Next, focus on your posture. Keep your back straight and shoulders relaxed to prevent strain while maintaining an efficient pace.

Incorporating varied terrain can elevate intensity. Hike uphill or navigate uneven paths to engage different muscle groups.

Consider interval training as well. Alternate between fast walking and a slower pace to enhance cardiovascular fitness.

Don’t forget hydration and nutrition before and after rucking calorie calculator. Proper fueling supports endurance while staying hydrated keeps energy levels high throughout your workout session.

Conclusion

Rucking calorie calculator combines strength and cardio into one powerful workout. It’s accessible, versatile, and offers significant benefits for anyone looking to enhance their fitness routine. By understanding how many calories you can burn, you can tailor your rucking sessions to meet your personal goals.

The factors that influence calorie burn—such as weight carried, distance covered, terrain type, and individual fitness levels—should guide how you approach each session. Utilizing a rucking calorie calculator will provide insight into the effectiveness of your workouts. This tool allows you to adjust intensity based on real data.

Don’t forget the tips shared earlier; they are crucial for maximizing your effort and results during every ruck. As with any exercise regimen, consistency is key.

Whether you’re new to rucking calorie calculator or a seasoned pro looking to refine your technique, keep pushing forward! Each step not only strengthens your body but also boosts mental resilience in the process. Embrace this unique workout and enjoy the journey toward better health and wellness through rucking!

-

HOME11 months ago

HOME11 months agoTarget Trends: What’s Hot in Stores Right Now?

-

BUSINESS11 months ago

BUSINESS11 months agoCustomer Satisfaction: Definition and Importance

-

HOME11 months ago

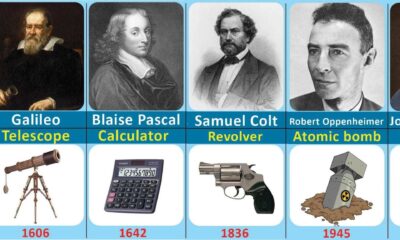

HOME11 months agoFrom Ideas to Innovations: How Inventors Change Our World

-

HOME6 months ago

HOME6 months ago300 Types of Flowers with Names from A to Z (and Pictures)

-

ENTERTAINMENT11 months ago

ENTERTAINMENT11 months agoFrom Isolation to Community: Strategies for Connecting with Readers

-

HEALTH11 months ago

HEALTH11 months agoThe Truth About Vasectomies: Myths, Facts, and Everything In Between

-

TECH10 months ago

TECH10 months agoThe Risks of Disconnecting Your AC Compressor: A Comprehensive Guide

-

HEALTH11 months ago

HEALTH11 months agoRevitalize Your Waistline: 7 Delicious Flat Stomach Detox Water Recipes for Weight Loss