BUSINESS

Lessons Learned: The Biggest Mistakes in Real Estate Investing and Their Solutions

Real estate investing can be a rewarding journey. Many dream of building wealth through property, but it’s not without its pitfalls. New investors often dive in headfirst, only to find themselves facing unexpected challenges. Every misstep offers valuable lessons, and understanding these mistakes is crucial for success.

Navigating the real estate market requires more than just enthusiasm; it demands careful planning and informed decision-making. Let’s explore common errors that many budding investors make and discover practical solutions to avoid them. Whether you’re just starting out or looking to refine your strategy, recognizing these mistakes can pave the way for smarter investments and greater returns.

Common Mistakes Made by New Investors

Many new investors dive into real estate without a clear strategy. This lack of direction often leads to costly errors.

Another prevalent mistake is neglecting thorough research. Understanding the market, analyzing neighborhoods, and knowing property values are crucial for success.

Emotions can also cloud judgment. Investors might fall in love with a property, ignoring its flaws or potential risks.

Additionally, some underestimate the importance of networking. Building relationships within the industry can offer invaluable insights and opportunities.

Many fail to account for the time commitment involved in managing properties effectively. Misjudging this aspect can lead to overwhelming stress down the line.

Lack of Research and Planning

Many new investors jump into real estate without adequate research. This rush often leads to missed opportunities and costly mistakes.

Understanding the market is crucial. Each area has its own dynamics, influenced by economic trends, neighborhood developments, and demographic shifts. Skipping this analysis can result in poor investment choices.

Planning goes hand-in-hand with research. A solid strategy outlines your goals and guides decision-making. Without it, investors may find themselves overwhelmed or lost in a sea of options.

Moreover, neglecting zoning laws and property regulations can have dire consequences. Familiarity with these factors ensures that investments align with local requirements.

Investing without thorough preparation feels like sailing blindfolded through uncharted waters—risky at best and disastrous at worst.

Overestimating Returns and Underestimating Expenses

Many new investors enter the real estate market with dreams of lucrative returns. However, one common pitfall is overestimating those potential earnings. Enthusiasm can cloud judgment, leading to unrealistic expectations.

Investors often neglect to account for various expenses that come with property ownership. Maintenance costs, property taxes, insurance, and vacancy rates can quickly add up. Failure to factor these into your budget may result in unexpected financial strain.

This miscalculation can create a ripple effect on cash flow and overall profitability. When reality doesn’t match expectations, stress levels rise.

To counteract this mistake, it’s essential to conduct thorough research on all associated costs before making an investment decision. Create a detailed spreadsheet outlining every possible expense related to the property you’re considering.

A realistic approach will provide a clearer picture of what you stand to gain—and lose—in your real estate journey.

Failing to Diversify Investments

Many new investors make the mistake of putting all their eggs in one basket. This strategy can lead to significant losses if that single investment falters.

Real estate markets fluctuate due to various factors such as economy, location, and demand. Relying solely on one type of property or market exposes you to higher risks.

Diversification allows you to spread your investments across different types of properties—residential, commercial, or industrial—and even various geographic locations. By doing this, you create a buffer against downturns in any specific sector.

Consider including alternative assets like real estate investment trusts (REITs) or crowdfunding platforms. These options can also provide steady returns without requiring extensive management from your end.

Investing wisely means not only focusing on potential profits but also safeguarding your portfolio against unforeseen events. Balance is key in navigating the intricate world of real estate investing.

Not Having a Contingency Plan

Real estate investing can be unpredictable. Market shifts, property issues, or unexpected expenses can hit when least expected. This is where a contingency plan becomes essential.

Many new investors overlook this critical element. They often operate under the assumption that everything will go smoothly. But without a backup strategy, they risk significant financial loss if things don’t pan out as planned.

A solid contingency plan should address various scenarios—like lower-than-expected rental income or sudden repair costs. Having reserves set aside for emergencies helps to cushion against potential fallout.

Moreover, consider alternative strategies for your investment properties. Whether it’s adjusting rent prices or exploring different financing options, flexibility in approach is key during tough times.

Investors who prepare for uncertainties are more likely to weather storms and seize opportunities when the market fluctuates unexpectedly. Taking proactive steps today lays down a stronger foundation for tomorrow’s success.

Solutions to Avoid These Mistakes

To sidestep the pitfalls of real estate investing, education is paramount. Attend workshops and read books that cover market trends, property management, and investment strategies. Knowledge equips you to make informed decisions.

Creating a solid business plan can help define your goals clearly. Outline potential expenses alongside expected revenues to maintain realistic expectations about returns. This practice keeps you grounded in reality.

Diversification is key to mitigating risk. Consider branching into different types of properties or geographic areas instead of putting all your capital into one venture.

Having a contingency plan prepares you for unexpected challenges like market downturns or maintenance emergencies. Set aside a reserve fund specifically for these situations.

Surround yourself with experienced professionals, such as real estate agents and financial advisors. Their insights can be invaluable in navigating complex decisions effectively while helping avoid common mistakes that plague many investors.

Importance of Continuous Learning in Real Estate Investing

Continuous learning is vital in real estate investing. The market evolves rapidly, influenced by economic trends, regulations, and consumer preferences. Staying updated helps investors adapt to changes effectively.

Learning can take many forms—attending workshops, reading industry reports, or networking with experienced professionals. Each interaction offers valuable insights that can shape investment strategies.

Additionally, understanding emerging technologies can give an edge. From property management software to virtual reality tours, innovation plays a significant role in enhancing efficiency and appeal.

Investors should also seek mentorship opportunities. Experienced mentors provide guidance tailored to unique challenges faced in the field. Their firsthand knowledge can prevent costly mistakes and foster growth.

Consider joining professional organizations or online forums where discussions about market conditions thrive. Engaging with others expands perspectives and promotes informed decision-making throughout your investment journey.

Conclusion

Real estate investing can be a rewarding journey filled with opportunities. However, it’s important to navigate this path wisely.

The mistakes that real estate investors make can often lead to setbacks. Learning from these errors is crucial for long-term success.

Embracing continuous education provides an edge in this competitive market. Staying informed about trends and strategies will keep you ahead of the curve.

Building a network of like-minded individuals also fosters growth and support. Sharing experiences opens up new perspectives that are invaluable.

With dedication and the right mindset, challenges turn into stepping stones towards achievement. The key lies not just in avoiding pitfalls but in evolving through them as well.

FAQs

Real estate investing can be complex. Many newcomers have similar questions.

One common query is about the best way to start. New investors often wonder if they should begin with residential or commercial properties. Each path has unique advantages and challenges.

Another frequent concern revolves around financing options. Investors want clarity on loans, down payments, and interest rates before taking any steps.

Additionally, many seek advice on managing properties effectively. Understanding tenant rights and maintenance responsibilities can seem overwhelming at first.

Some ask how to evaluate potential investments accurately. Learning about market trends and property values is crucial for making informed decisions.

These FAQs highlight the importance of seeking guidance in real estate investing journeys.

BUSINESS

Why Every Business Needs Insurance (Even Yours)

Running a business feels like juggling flaming torches while riding a unicycle. You’re managing employees, serving customers, tracking finances, and trying to grow—all while hoping nothing goes catastrophically wrong. Yet most business owners operate without adequate insurance protection, essentially performing their high-wire act without a safety net.

Business insurance isn’t just another expense to grudgingly add to your budget. It’s the foundation that allows you to take calculated risks, protect your hard-earned assets, and sleep soundly knowing that unexpected events won’t destroy everything you’ve built. Whether you’re a solo consultant working from home or managing a growing company with dozens of employees, the right insurance coverage can mean the difference between a temporary setback and permanent closure.

This guide breaks down everything you need to know about business insurance, from essential coverage types to practical tips for choosing the right policies. We’ll explore real scenarios where insurance saves businesses, common myths that leave entrepreneurs vulnerable, and actionable steps to protect your company without breaking your budget.

Understanding Business Insurance Fundamentals

Business insurance protects your company against financial losses from unexpected events. Unlike personal insurance, business coverage addresses the unique risks companies face—from customer lawsuits and employee injuries to equipment theft and cyber attacks.

The core principle behind business insurance involves transferring risk from your company to an insurance provider. In exchange for regular premium payments, the insurance company agrees to cover specified losses up to policy limits. This arrangement allows you to operate with confidence, knowing that covered incidents won’t drain your business bank account or force you into bankruptcy.

Different businesses face different risks, which means insurance needs vary significantly across industries and company sizes. A restaurant faces different challenges than a consulting firm, and a home-based business has different exposure than a company with physical locations. Understanding your specific risk profile helps determine which types of coverage are essential versus optional.

Business insurance also serves purposes beyond just financial protection. Many contracts, leases, and licensing agreements require specific insurance coverage. Some clients won’t work with uninsured vendors, and certain business loans mandate insurance as a condition of funding. Having proper coverage opens doors that remain closed to uninsured competitors.

Essential Business Insurance Types

General liability insurance forms the foundation of most business insurance programs. This coverage protects against claims of bodily injury, property damage, and personal injury (such as libel or slander) that occur during normal business operations. If a customer slips and falls in your store, or if your service accidentally damages a client’s property, general liability insurance covers legal costs and settlements.

Professional liability insurance, also known as errors and omissions (E&O) insurance, protects service-based businesses against claims of negligence, mistakes, or failure to deliver promised services. Consultants, lawyers, accountants, and other professionals rely on this coverage when clients claim that professional advice or services caused financial harm.

Property insurance protects physical business assets including buildings, equipment, inventory, and supplies. This coverage extends beyond obvious perils like fire and theft to include events like vandalism, storms, and pipe bursts. For businesses that depend on physical assets to operate, property insurance prevents minor incidents from becoming major financial disasters.

Workers’ compensation insurance covers medical expenses and lost wages when employees are injured on the job. Most states require this coverage for businesses with employees, and the requirements vary by state and industry. Even if not legally required, workers’ compensation protects both employees and employers by providing a clear framework for handling workplace injuries.

Cyber liability insurance has become increasingly important as businesses rely more heavily on digital systems and data storage. This coverage addresses costs associated with data breaches, including notification expenses, credit monitoring for affected customers, legal fees, and regulatory fines. With cyber attacks targeting businesses of all sizes, this protection is no longer optional for companies that store customer information electronically.

Commercial auto insurance covers vehicles used for business purposes. Whether you own a fleet of delivery trucks or occasionally use your personal car for business trips, commercial auto coverage protects against accidents and liability claims that personal auto policies typically exclude.

Determining Your Business Insurance Needs

Assessing your it needs starts with identifying the risks your business faces. Consider your industry, business model, physical location, employee count, and revenue streams. A manufacturing company faces different risks than a digital marketing agency, and these differences should be reflected in insurance coverage choices.

Physical risks include damage to property, equipment, or inventory from events like fires, storms, theft, or accidents. Service businesses might have minimal physical assets, while retail stores and manufacturers typically require substantial property coverage. Consider not just the replacement cost of physical assets, but also the business interruption costs if operations must temporarily cease.

Liability risks arise from interactions with customers, clients, employees, and the general public. These risks exist for virtually every business, though the severity varies significantly. Professional service providers face different liability exposures than retail stores, and businesses with physical locations have different risks than home-based operations.

Regulatory and legal requirements often dictate minimum insurance coverage. Workers’ compensation requirements vary by state, and some business licenses mandate specific insurance types. Professional licenses frequently require professional liability coverage, and commercial leases typically specify minimum general liability limits.

Financial considerations play a crucial role in determining appropriate coverage levels. Higher coverage limits cost more but provide greater protection. Deductibles affect both premium costs and out-of-pocket expenses when claims occur. Balance your ability to pay premiums against your capacity to absorb potential losses, considering both frequency and severity of potential claims.

Industry-specific risks require specialized coverage considerations. Restaurants need coverage for foodborne illness claims, construction companies face unique liability exposures, and technology companies must address intellectual property risks. Research common it claims in your industry to identify coverage gaps that generic policies might not address.

Common Business Insurance Mistakes

Many business owners underestimate their insurance needs, choosing minimal coverage to save money on premiums. This penny-wise, pound-foolish approach leaves businesses vulnerable to claims that exceed policy limits. Adequate coverage limits should reflect both the potential severity of claims and your business’s ability to pay for uncovered losses.

Mixing personal and business it creates dangerous coverage gaps. Personal auto policies typically exclude business use, and homeowners insurance rarely covers business equipment or liability. Attempting to save money by using personal policies for business purposes often results in denied claims when coverage is needed most.

Failing to update coverage as businesses grow and change leads to inadequate protection. The insurance that worked when you started might not address current risks. Regular insurance reviews ensure that coverage limits, policy types, and beneficiaries reflect your current business situation.

Choosing insurance based solely on price ignores important factors like coverage quality, claims handling reputation, and financial stability of insurance companies. The cheapest policy often provides the least comprehensive coverage, and insurers with poor claims handling can make recovery difficult even when coverage exists.

Neglecting to read and understand policy terms leaves business owners surprised when claims are denied. Insurance policies contain specific exclusions, conditions, and requirements that affect coverage. Understanding these terms before purchasing helps avoid unpleasant surprises during stressful claim situations.

Procrastinating on it decisions until after problems occur eliminates protection when it’s needed most. Insurance cannot be purchased retroactively, and waiting until risks materialize often means operating without protection during critical periods.

Choosing the Right Insurance Provider

Insurance company selection involves more than comparing premium quotes. Financial stability ratings from agencies like A.M. Best, Standard & Poor’s, and Moody’s indicate an insurer’s ability to pay claims. Companies with strong financial ratings are more likely to remain solvent and able to honor policy obligations during difficult economic periods.

Claims handling reputation significantly impacts your experience when filing claims. Research customer reviews, complaint ratios with state insurance departments, and ask for references from other business owners. An insurer that handles claims efficiently and fairly is worth paying slightly higher premiums.

Industry expertise matters when selecting insurance providers. Companies that specialize in your industry understand common risks and can provide more appropriate coverage recommendations. They’re also more likely to have competitive pricing for industry-specific risks.

Agent and broker relationships provide ongoing value beyond initial policy purchase. Knowledgeable agents help you understand coverage options, assist with claims, and provide risk management advice. Choose agents who take time to understand your business and provide proactive service rather than just selling policies.

Coverage options and flexibility allow you to customize insurance programs to match your specific needs. Some insurers offer package policies that combine multiple coverage types, while others provide more flexibility to purchase individual policies. Consider both current needs and future growth when evaluating coverage options.

Geographic considerations affect both coverage availability and pricing. Some insurers don’t operate in all states, and coverage for businesses with multiple locations can be complex. Ensure your chosen insurer can provide consistent coverage across all business locations.

Making Business Insurance Work for Your Budget

Insurance costs vary significantly based on industry, location, coverage limits, and risk factors. Understanding how premiums are calculated helps you make informed decisions about coverage levels and risk management strategies.

Deductibles directly impact premium costs and out-of-pocket expenses during claims. Higher deductibles reduce premiums but increase the amount you pay when filing claims. Choose deductibles you can comfortably afford to pay, considering both your cash flow and emergency fund availability.

Risk management practices can reduce insurance costs while improving business operations. Safety programs, security systems, employee training, and proper maintenance demonstrate to insurers that you’re actively working to prevent losses. Many insurers offer premium discounts for businesses with strong risk management programs.

Package policies often cost less than purchasing individual coverage types separately. Business owner’s policies (BOPs) combine general liability, property insurance, and business interruption coverage at attractive rates for qualifying small businesses. Professional liability and other specialized coverages can often be added to package policies.

Annual policy reviews help ensure you’re not overpaying for coverage you don’t need or underinsured for risks you face. Business changes, claims experience, and market conditions all affect appropriate coverage levels and costs. Regular reviews with your agent or broker can identify cost-saving opportunities and coverage gaps.

Payment options affect cash flow management. Many insurers offer monthly payment plans instead of requiring annual premium payments upfront. While monthly payments typically include service fees, they can help manage cash flow for growing businesses.

Protecting Your Business’s Future

Business insurance represents an investment in your company’s stability and growth potential. Adequate coverage provides the confidence to pursue opportunities, take calculated risks, and weather unexpected challenges that could otherwise destroy years of hard work.

Start by conducting a thorough risk assessment of your business operations, identifying potential sources of loss and liability. This assessment should include physical assets, liability exposures, regulatory requirements, and industry-specific risks. Use this information to create a prioritized list of insurance needs.

Obtain quotes from multiple insurance providers, but remember that the lowest price doesn’t always provide the best value. Compare coverage terms, exclusions, deductibles, and claims handling reputations alongside premium costs. Consider working with an experienced agent or broker who can help navigate complex coverage options.

Implement risk management practices that complement your insurance coverage. While insurance transfers financial risk, preventing losses altogether is always preferable. Safety programs, security measures, employee training, and proper maintenance reduce both insurance costs and operational disruptions.

Review your insurance program annually or whenever significant business changes occur. Growing companies, new locations, additional employees, and changing regulations all affect insurance needs. Regular reviews ensure your coverage evolves with your business.

Don’t let another day pass with inadequate it protection. The risks your business faces are real, and the consequences of being uninsured or underinsured can be devastating. Contact qualified insurance professionals to discuss your coverage needs and build a comprehensive protection plan that allows your business to thrive regardless of what challenges arise.

BUSINESS

Navigating the Digital Frontier: How Businesses in Zanzibar Can Thrive Online

Welcome to the digital age, where a world of opportunities lies just a click away. For businesses in Zanzibar, this era offers an unprecedented chance to expand their reach and connect with customers beyond the beautiful shores of the island. As more consumers turn to online platforms for shopping and engagement, understanding how to navigate this digital frontier is crucial for success.

Imagine harnessing the power of technology to showcase your unique products or services while attracting tourists from around the globe. Whether you’re a local artisan selling handcrafted goods or a hospitality business looking to attract visitors, going digital can transform your operations and elevate your brand presence. Let’s explore how businesses in Zanzibar can thrive online amid challenges while embracing innovative tools that make their journeys smoother and more rewarding!

The Current State of Online Business in Zanzibar

Zanzibar’s online business landscape is evolving, yet it remains in its infancy. Many local entrepreneurs are just beginning to explore the digital space. Traditional markets still dominate, but a noticeable shift is underway.

The rise of smartphones has opened new doors for small businesses. Many have started using social media platforms to reach broader audiences beyond their immediate neighborhoods. However, challenges like inconsistent internet connectivity hinder progress.

E-commerce is slowly gaining traction as well. More Zanzibari artisans and vendors are setting up online shops to showcase unique products such as spices and crafts. The potential for growth is immense.

Yet, there remains a disparity in understanding digital tools among various sectors. Some businesses struggle with branding and marketing strategies that could elevate their visibility online. This highlights the need for education on digital best practices within the community.

Why Going Digital Is Essential for Businesses in Zanzibar

Embracing the digital landscape is no longer optional for businesses in Zanzibar. The world is moving online, and so must local enterprises to stay competitive.

Digital platforms offer unprecedented reach. Businesses can connect with a global audience, showcasing their unique products and services beyond local borders. This exposure opens doors to new markets and opportunities.

Moreover, going digital enhances efficiency. Automated processes simplify operations, reducing costs while improving service delivery. Customers appreciate quick responses and seamless transactions.

The COVID-19 pandemic has highlighted the importance of adaptability. Those who pivoted to online models not only survived but thrived during challenging times.

Establishing an online presence builds credibility. A well-designed website or active social media profiles instill trust among potential customers eager to engage with brands that reflect professionalism and reliability.

Overcoming Challenges: Internet Access and Infrastructure

Zanzibar’s beauty attracts many, but digital connectivity remains a challenge. Many areas still struggle with limited internet access. This hinders businesses from reaching their full potential online.

Improving infrastructure is crucial for the island’s economic growth. Investment in modern telecommunications can bridge the gap between local entrepreneurs and global markets. Enhanced connectivity opens doors to new opportunities.

Collaboration among government, private sector, and communities can drive change. Local initiatives aimed at boosting internet availability are essential for empowering small businesses.

Promoting tech-savvy solutions like community Wi-Fi hotspots may also help improve accessibility. By addressing these barriers head-on, Zanzibar can create an environment where online commerce thrives and innovation flourishes across all sectors of the economy.

Leveraging Social Media for Marketing and Networking

Social media is a powerful tool for businesses in Zanzibar. It offers an unparalleled platform to connect with customers and build brand awareness.

Engaging content can showcase local culture, products, and services while resonating with the audience. Creative posts that highlight unique aspects of Zanzibar will capture attention quickly.

Networking opportunities abound on platforms like Facebook, Instagram, and Twitter. Businesses can join groups relevant to their niche or collaborate with influencers who share similar values.

Timely responses to comments and messages enhance customer relationships. Transparency fosters trust among potential clients.

Running targeted ads allows companies to reach specific demographics within the region or beyond. This precision leads to better conversion rates.

Utilizing analytics tools offers insights into what works best. Understanding audience behavior enables businesses to refine their strategies effectively as they grow online presence in Zanzibar’s vibrant market landscape.

Utilizing E-commerce Platforms for Selling Products and Services

E-commerce platforms are game changers for businesses in Zanzibar. They offer a global marketplace, allowing local entrepreneurs to showcase their products and services beyond the island.

Setting up an online store is now more accessible than ever. With various user-friendly options like Shopify, WooCommerce, or Etsy, even those with limited tech skills can create beautiful storefronts.

These platforms also provide essential tools for managing inventory and processing payments securely. This streamlines operations and enhances customer trust.

Marketing through e-commerce is equally vital. Businesses can utilize SEO strategies to attract more visitors and use analytics to understand buyer behavior better.

Moreover, e-commerce enables round-the-clock sales opportunities. Customers can browse and shop at their convenience, leading to increased revenue potential for Zanzibari businesses eager to grow in the digital age.

The Importance of a User-Friendly Website

A user-friendly website is crucial for businesses in Zanzibar to capture and retain customers. First impressions matter, and a well-designed site creates trust and credibility.

Navigation should be seamless. Visitors want to find information quickly without feeling lost. An intuitive layout encourages exploration, leading to increased engagement.

Loading speed also plays a vital role. Slow websites frustrate users, making them more likely to leave before they even see what you offer. Fast-loading pages keep potential customers interested.

Mobile optimization cannot be overlooked either. Many people browse on their smartphones while traveling around the beautiful streets of Zanzibar. A responsive design ensures your site looks great on any device.

Clear calls-to-action guide visitors toward desired actions—whether that’s making a purchase or signing up for newsletters. A friendly interface paired with thoughtful design can significantly enhance the online experience for everyone who visits your business’s digital space.

Embracing Technology: Virtual Meetings and Remote Workforce

The rise of technology has transformed how businesses operate worldwide, and Zanzibar is no exception. Virtual meetings have become a vital tool for collaboration. They allow teams to connect seamlessly, regardless of location.

With a stable internet connection, local professionals can engage with clients and partners around the globe. This flexibility opens doors to new opportunities that were once limited by geographic barriers.

A remote workforce also enables companies in Zanzibar to tap into diverse talent pools. Employees can contribute from various regions while maintaining a work-life balance that suits them best.

Investing in the right tools fosters productivity and enhances communication among team members. As businesses embrace these technologies, they position themselves competitively on the global stage.

Zanzibar’s vibrant culture and entrepreneurial spirit can thrive even further when technology bridges gaps and facilitates innovation across industries.

BUSINESS

A Beginner’s Guide to Choosing the Right Labels for Your Products

When it comes to product branding and packaging, labels play a crucial role in attracting customers, conveying essential information, and establishing a brand identity. Choosing the right labels for your products may seem like a small detail, but it can significantly impact your business’s success. This guide will walk you through the key factors to consider when selecting product labels, ensuring that you make an informed decision that enhances your product’s appeal and functionality.

Understanding the Purpose of Product Labels

Before diving into the different types of labels available, it is essential to understand why labels are important. A well-designed label serves multiple purposes, including:

- Brand Recognition: Labels help create a strong brand identity by showcasing your logo, color scheme, and design elements.

- Regulatory Compliance: Many industries require labels to include specific information such as ingredients, expiration dates, or safety warnings.

- Marketing and Sales: Eye-catching labels can influence purchasing decisions by making products stand out on store shelves.

- Consumer Information: Labels provide crucial details like usage instructions, nutritional information, or contact details for customer support.

Types of Labels

There are various types of labels available, each catering to different product needs. Some of the most common include:

1. Pressure-Sensitive Labels

These are the most commonly used labels in the industry. They are self-adhesive and can be easily applied to a variety of surfaces, including glass, plastic, and metal. They are available in paper, film, and foil materials, making them a versatile choice for most products.

2. Shrink Sleeves

Shrink sleeve labels provide 360-degree coverage, making them ideal for products with unique shapes. They are applied to the container and then shrunk using heat to conform to its shape. These labels are often used for beverages, cosmetics, and pharmaceutical products.

3. In-Mold Labels

These labels are embedded into the product packaging during the molding process. They offer durability and a seamless finish, making them ideal for plastic containers and food packaging.

4. Heat Transfer Labels

Heat transfer labels involve applying graphics directly onto the product’s surface using heat and pressure. This method is commonly used for sports equipment, apparel, and industrial products.

5. Direct Thermal & Thermal Transfer Labels

These labels are widely used for barcodes, shipping labels, and retail applications. Direct thermal labels do not require ink or toner, whereas thermal transfer labels use a ribbon for enhanced durability.

Choosing the Right Material

Selecting the right material for your labels is just as important as choosing the right type. Some of the most common label materials include:

- Paper Labels: Affordable and suitable for dry products such as food packaging and office supplies.

- Vinyl Labels: Waterproof and highly durable, making them perfect for outdoor and industrial use.

- Polyester Labels: Resistant to chemicals, heat, and moisture, commonly used for electronics and machinery.

- Foil Labels: Provide a luxurious and premium feel, often used for high-end products like wine bottles and cosmetics.

Factors to Consider When Choosing Product Labels

1. Durability

Consider the environmental conditions your labels will face. If your products are exposed to moisture, heat, or friction, opt for water-resistant or heat-resistant labels.

2. Adhesive Type

Different adhesives provide varying levels of stickiness. Permanent adhesives are ideal for long-term use, while removable adhesives work well for products that require reusability.

3. Design and Customization

Your label should reflect your brand identity and attract customers. Custom printing options such as embossing, foil stamping, and spot UV coating can enhance the visual appeal of your labels.

4. Compliance and Regulations

Depending on your industry, your labels may need to comply with certain regulations. For example, food labels must include nutritional information, while pharmaceutical labels must provide dosage instructions and warnings.

5. Printing Method

Choose a printing method that suits your budget and quality expectations. Digital printing is cost-effective for small batches, while offset printing offers high-quality results for large-scale production.

Conclusion

Selecting the right labels for your products involves considering various factors, including material, durability, adhesive type, and compliance requirements. Investing time and effort into choosing the right labels can enhance your brand’s visibility, protect your products, and attract more customers. By understanding the options available and making informed decisions, you can create labels that not only look great but also serve their intended purpose effectively.

FAQs

1. What is the most durable label material?

Polyester and vinyl labels are among the most durable options, offering resistance to moisture, chemicals, and heat.

2. Are removable labels reusable?

Removable labels can often be reapplied, but their reusability depends on the adhesive quality and the surface they were applied to.

3. What type of label is best for food packaging?

Paper labels with food-safe adhesives are commonly used for dry foods, while shrink sleeves and vinyl labels work well for perishable items.

4. Can I print my own labels at home?

Yes, you can print labels at home using inkjet or laser printers, but for high-quality results, professional printing services are recommended.

5. Do I need to comply with labeling regulations?

Yes, depending on your industry, you may be required to include specific information such as ingredient lists, barcodes, or safety warnings.

-

HOME11 months ago

HOME11 months agoTarget Trends: What’s Hot in Stores Right Now?

-

BUSINESS11 months ago

BUSINESS11 months agoCustomer Satisfaction: Definition and Importance

-

HOME11 months ago

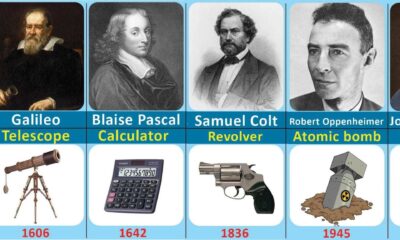

HOME11 months agoFrom Ideas to Innovations: How Inventors Change Our World

-

HOME6 months ago

HOME6 months ago300 Types of Flowers with Names from A to Z (and Pictures)

-

ENTERTAINMENT11 months ago

ENTERTAINMENT11 months agoFrom Isolation to Community: Strategies for Connecting with Readers

-

HEALTH11 months ago

HEALTH11 months agoThe Truth About Vasectomies: Myths, Facts, and Everything In Between

-

TECH10 months ago

TECH10 months agoThe Risks of Disconnecting Your AC Compressor: A Comprehensive Guide

-

HEALTH11 months ago

HEALTH11 months agoRevitalize Your Waistline: 7 Delicious Flat Stomach Detox Water Recipes for Weight Loss