CRYPTO

Why Every Trader Should Consider Crypto30x.com in Their Gemini Portfolio

Cryptocurrency trading has taken the financial world by storm, and if you’re not paying attention, you might be missing out on a golden opportunity. One platform that’s making waves in this dynamic space is Crypto30x.com. Paired with Gemini, a trusted exchange known for its security and user-friendly interface, traders are now able to explore new avenues of investment.

As the popularity of cryptocurrency continues to surge, savvy investors are looking for tools that can help them navigate this complex landscape. With robust features and unique offerings, Crypto30x.com stands out as an essential addition to any trader’s portfolio. Whether you’re just starting or have years of experience under your belt, understanding how to leverage Crypto30x.com could set you apart from the competition. Are you ready to discover what makes it so compelling?

The Growing Popularity of Cryptocurrency Trading

Cryptocurrency trading has surged in recent years, capturing the attention of investors worldwide. As traditional markets experience volatility, traders are increasingly turning to digital assets for diversification.

This shift is driven by a blend of factors. More people are recognizing cryptocurrencies as viable investment options. The potential for high returns continues to attract both novice and experienced traders alike.

Social media plays a significant role in this trend. Platforms like Twitter and Reddit have become hotspots for discussions about crypto trends, fostering communities that share insights and strategies.

Furthermore, the accessibility of trading platforms has made it easier than ever to dive into the world of cryptocurrency. With just a smartphone and an internet connection, anyone can start trading within minutes.

As awareness grows and technology evolves, it’s clear that cryptocurrency trading is here to stay.

Advantages of Adding Crypto30x.com to Your Gemini Portfolio

Adding Crypto30x.com to your Gemini portfolio can elevate your trading game. This platform offers access to a diverse range of cryptocurrencies, enabling traders to explore new opportunities.

One standout feature is the potential for high leverage. With 30x leverage available, traders can amplify their positions and potentially increase profits without needing substantial capital upfront.

Moreover, the user-friendly interface makes it easy for both beginners and experienced traders to navigate. You don’t need advanced technical skills to get started on this platform.

Crypto30x.com also prioritizes security, ensuring that transactions are safe and private. This peace of mind allows you to focus more on trading strategies rather than worrying about risks.

The combination of these advantages creates an enticing environment for any trader looking to expand their crypto holdings through Gemini.

Unique Features and Benefits of Crypto30x.com

Crypto30x.com stands out with its innovative trading tools tailored for both novice and seasoned traders. The platform offers a user-friendly interface that simplifies the complex world of cryptocurrency trading.

One key feature is its advanced algorithm, which analyzes market trends in real time. This helps users make informed decisions quickly and efficiently.

Additionally, Crypto30x.com provides educational resources to enhance your trading skills. From webinars to in-depth articles, you’ll find everything you need to become a more confident trader.

Security is another priority here. With cutting-edge encryption technologies, your investments remain protected from cyber threats.

The community aspect also sets it apart. Engaging forums allow traders to share insights, strategies, and experiences—fostering collaboration among users.

Testimonials from Successful Traders on Crypto30x.com

Traders have taken to the platform with enthusiasm, sharing their experiences on Crypto30x.com. Many highlight its user-friendly interface, which makes navigating complex trades a breeze.

One trader noted how they doubled their investment within just weeks of using the site. They praised the real-time analytics that informed their decisions effectively.

Another member emphasized the supportive community surrounding Crypto30x.com. Engaging with fellow traders has provided invaluable insights and strategies for maximizing gains.

With diverse trading options available, users appreciate having flexibility in building their portfolios. A seasoned investor remarked on how easy it was to diversify risk while still capitalizing on market trends.

These testimonials reflect a growing trust among traders who view Crypto30x.com as more than just another trading platform; it’s become an essential tool for success in cryptocurrency markets today.

How to Get Started with Crypto30x.com on Gemini

Getting started with Crypto30x.com on Gemini is a simple process that can open up new trading opportunities. First, ensure you have an active Gemini account. If not, creating one takes just a few minutes.

Once your account is set up, visit the Crypto30x.com website. Here, you’ll find user-friendly guides to help you navigate through the platform. Familiarize yourself with its features and tools designed for efficient trading.

After logging in to Crypto30x.com using your Gemini credentials, take advantage of their demo accounts if you’re new to crypto trading. This allows you to practice without any financial risk.

When you’re ready, fund your account directly from Gemini and start exploring various cryptocurrencies available for trading. The intuitive interface makes it easy to track market trends and make informed decisions as you grow your portfolio with confidence.

Conclusion: Why You Shouldn’t Miss Out on the Opportunity of Crypto30x.com in 2022

The potential of Crypto30x.com is undeniable. As cryptocurrency continues to reshape the financial landscape, traders need platforms that can keep pace with their ambitions.

Crypto30x.com offers tools and features tailored for both novice and seasoned investors. This is not just another trading platform; it’s a gateway to enhanced opportunities.

With its unique offerings, users can diversify their portfolios efficiently. The integration with Gemini adds an extra layer of security and trustworthiness.

Staying ahead in the crypto world means being open to innovation. Don’t let this chance slip through your fingers in 2022—explore what Crypto30x.com has to offer today.

FAQs

What is Crypto30x.com?

Crypto30x.com is an innovative trading platform designed to enhance your cryptocurrency experience. It offers a range of tools and features that cater to both novice and experienced traders.

How does Crypto30x.com integrate with Gemini?

Crypto30x.com seamlessly integrates with your Gemini account, allowing you to manage your crypto assets in one place while taking advantage of advanced trading options.

Can I access Crypto30x.com on mobile devices?

Yes, Crypto30x.com provides a user-friendly interface that can be accessed through mobile devices. This flexibility allows you to trade on the go without missing any opportunities.

Is there a minimum investment required for Crypto30x.com?

While specific requirements may vary, many users find it accessible regardless of their budget. It’s important to check the latest guidelines directly on the platform for detailed information.

Are there any fees associated with using Crypto30x.com?

There may be transaction fees depending on your trading activity. Always review the fee structure provided by Crypto30x.com before starting trades.

What support does Crypto30x.com offer its users?

The platform prides itself on excellent customer service, offering resources like live chat support, tutorials, and educational materials for users at all levels.

By considering these FAQs as part of your research into integrating Crypto30x.com into your Gemini portfolio, you’ll be better equipped to make informed decisions moving forward in 2022 and beyond. Don’t miss out on what could potentially change how you trade cryptocurrencies forever!

CRYPTO

Unlocking Freedom: The Benefits of Crypto Debit Cards with No KYC

The world of finance is evolving, and cryptocurrency is at the forefront of this revolution. With digital currencies gaining traction, many people are looking for ways to spend their crypto easily and efficiently. Enter crypto debit cards — a bridge between traditional currency and the burgeoning world of digital assets. But what if you could enjoy all those benefits without going through lengthy Know Your Customer (KYC) processes? That’s where crypto debit cards with no KYC come into play. They promise not just convenience but also greater freedom in managing your finances. Curious about how these innovative tools can enhance your financial journey? Let’s dive deeper into what makes them so appealing!

Understanding Cryptocurrency and KYC

Cryptocurrency is a digital or virtual form of currency that utilizes cryptography for security. Unlike traditional currencies issued by governments, cryptocurrencies operate on decentralized networks based on blockchain technology. This transparency and security make them attractive to many users.

However, with this innovation comes the need for regulations. Know Your Customer (KYC) guidelines require financial institutions to verify their customers’ identities. These rules aim to prevent fraud, money laundering, and other illicit activities within the crypto space.

While KYC helps bolster trust in transactions, it can also create barriers for those who prioritize privacy and autonomy over their finances. Users often find themselves reluctant to share personal information just to access financial services. The desire for anonymity has led many individuals to seek alternatives that bypass these stringent requirements while still allowing them to utilize their cryptocurrency effectively.

The Rise of Crypto Debit Cards

The world of finance is evolving, and crypto debit cards are leading the charge. These innovative financial tools combine the convenience of traditional debit cards with the power of cryptocurrency.

Over recent years, there has been a significant uptick in demand for seamless transactions. Crypto debit cards offer an easy way to spend digital currencies at millions of merchants worldwide. No need to convert assets; simply swipe and go.

As cryptocurrencies gain traction among consumers, companies have responded by developing user-friendly interfaces for these cards. Many provide mobile apps that allow users to track their spending in real time.

Moreover, as mainstream adoption increases, we see more partnerships between crypto wallets and card issuers. This integration makes it simpler than ever to access funds stored in digital assets while enjoying immediate purchasing power without hassle.

Advantages of Using Crypto Debit Cards with No KYC

Crypto debit cards with no KYC offer a range of appealing benefits. First and foremost, they provide a seamless user experience. You can make transactions without the lengthy verification processes typical of traditional banking.

Another significant advantage is enhanced privacy. Without KYC requirements, users retain greater control over their personal information. This feature appeals to those who value discretion in their financial dealings.

Moreover, these cards enable swift access to funds stored in various cryptocurrencies. Users can convert crypto into fiat instantly for everyday purchases or online shopping.

Additionally, many crypto debit cards come with competitive fees compared to conventional bank-issued cards. This cost-effectiveness makes them an attractive option for frequent travelers and digital nomads alike.

There’s the convenience factor; you can use your card anywhere that accepts major payment networks globally—without geographical restrictions or hurdles.

Increased Privacy and Security

One of the standout features of crypto debit cards is their commitment to privacy. Unlike traditional banking options, these cards often require minimal personal information. This means users can transact without exposing sensitive details.

The decentralized nature of cryptocurrencies further enhances security. Transactions do not rely on centralized databases that hackers typically target. Instead, they utilize blockchain technology, which adds layers of encryption and transparency.

Users also have control over their funds and transactions. With a crypto debit card, you decide how much information to share at any given moment. This autonomy fosters a more secure experience when spending or withdrawing cash.

Additionally, many crypto debit card providers offer advanced security measures such as two-factor authentication and biometric verification. These options ensure that only legitimate users can access their funds while keeping unwanted intruders at bay.

Global Accessibility and Convenience

Crypto debit cards are revolutionizing how individuals access their funds globally. With these cards, you can spend your digital assets just like traditional money. This means purchasing goods and services anywhere that accepts standard debit cards.

Imagine traveling abroad without the hassle of currency exchanges or high fees. Just load your crypto onto the card and use it seamlessly in different countries. It’s as easy as swiping at any point of sale terminal.

Additionally, there’s no need to worry about banking restrictions common with conventional financial systems. Crypto debit cards empower users in areas where traditional banking is limited or unavailable.

The convenience extends to online shopping too. You can make purchases on international platforms without jumping through hoops for conversions or approvals. Everything happens instantly, making transactions smooth and efficient; a true game changer for global commerce.

Potential Drawbacks to Consider

While crypto debit cards offer exciting benefits, there are potential drawbacks that users should keep in mind.

One significant concern is the volatility of cryptocurrencies. Prices can fluctuate dramatically, which may affect the value of your holdings when converted to fiat currency for transactions.

Another factor to consider is limited acceptance. Not all merchants accept crypto debit cards yet. This could result in inconvenience if you’re relying solely on cryptocurrency for purchases.

Additionally, some platforms might impose hidden fees or unfavorable exchange rates when converting your crypto assets into local currency. It’s essential to read the fine print and understand any associated costs before committing.

Using a card with no KYC means you’re opting out of identity verification processes that can enhance security against fraud and theft. Weighing these considerations carefully will help ensure you make an informed choice about using a crypto debit card.

Conclusion: Why You Should Consider a Crypto Debit Card with No KYC

Crypto debit cards with no KYC offer a unique opportunity for users seeking both flexibility and privacy in their financial transactions. By eliminating the cumbersome verification processes, these cards empower individuals to access their cryptocurrency funds seamlessly.

The allure of increased anonymity cannot be overstated. In an age where data security is paramount, maintaining control over personal information becomes essential. Without KYC requirements, you can enjoy peace of mind knowing your identity remains protected.

Additionally, global accessibility allows you to transact across borders effortlessly. Whether you’re traveling or managing international payments, crypto debit cards simplify the process significantly.

Embracing this innovative payment method could lead to a more liberated lifestyle. If you value convenience and discretion in your financial dealings, exploring crypto debit cards without KYC may be worth considering as part of your overall strategy for digital finance management.

FAQs

Navigating the world of cryptocurrency can be complex, but it offers exciting possibilities. Crypto debit cards are a bridge between traditional finance and the digital currency realm. By removing KYC (Know Your Customer) requirements, these cards present unique advantages that cater to different user needs.

What is a crypto debit card?

A crypto debit card allows users to spend their cryptocurrencies directly at physical or online stores. It converts your digital assets into local currency at the point of sale.

Are there fees associated with using crypto debit cards?

Yes, while many providers offer competitive rates, users should review fee structures carefully. Be aware of transaction fees, monthly maintenance charges, and conversion costs.

Is my information safe when using a no KYC crypto debit card?

While these cards enhance privacy by not requiring personal data for verification, it’s crucial to use reputable services. Conduct thorough research on security measures provided by each platform before committing.

Can I load multiple cryptocurrencies onto a single card?

Many modern crypto debit cards support multiple currencies. This feature adds flexibility and convenience for users managing various digital assets.

How do I select the right crypto debit card for me?

Consider factors like supported cryptocurrencies, fees, ease of use, and customer service when choosing a provider. User reviews can also provide valuable insights into performance and reliability.

Exploring the benefits offered by no KYC crypto debit cards opens up new avenues in financial freedom. With careful consideration of both advantages and drawbacks, you can make informed decisions tailored to your lifestyle needs.

CRYPTO

Understanding Blockchain Technology: The Backbone of Cryptocurrency

Blockchain technology has taken the digital world by storm. It’s not just a buzzword; it’s a groundbreaking innovation that underpins cryptocurrency and so much more. Picture this: a secure, transparent ledger that records transactions in real-time, accessible to everyone but tamper-proof at the same time. Sounds impressive, right?

As we delve deeper into blockchain technology, we’ll uncover how it works and why it matters. Many people associate blockchain solely with Bitcoin or other cryptocurrencies, but its potential extends far beyond finance. From supply chain management to healthcare data security, the applications are vast and varied.

Join us on this journey as we explore what makes blockchain technology revolutionary and discover its impact across different sectors of our daily lives!

How Blockchain Works

Blockchain operates as a decentralized ledger technology. It records transactions across multiple computers, ensuring that the data is secure and unchangeable.

Every transaction creates a block. This block contains crucial information—such as time stamps and transaction details. Once validated, it links to the previous block, forming a chronological chain.

Consensus mechanisms play a vital role in this process. They ensure all participants agree on the validity of transactions before they are added to the blockchain. Popular methods include Proof of Work and Proof of Stake.

The distributed nature enhances security. A hacker would need to control over 50% of the network to alter any data successfully, making such an attack highly improbable.

Smart contracts further expand blockchain functionality. These self-executing contracts automatically enforce agreements when predefined conditions are met, streamlining processes without intermediaries.

The Advantages of Utilizing Blockchain Technology

Blockchain technology offers enhanced transparency. Every transaction is recorded on a public ledger, allowing anyone to verify the data independently. This openness fosters trust among parties.

Security is another significant advantage. The decentralized nature of blockchain makes it difficult for hackers to manipulate records. Each block contains cryptographic hashes linking it securely to the previous one, creating an unbreakable chain.

Efficiency also improves with blockchain adoption. Traditional systems often involve multiple intermediaries, leading to delays and higher costs. Blockchain streamlines processes by allowing direct transactions between parties.

Cost reduction cannot be overlooked either. By eliminating middlemen and reducing administrative expenses, businesses can save substantial amounts over time.

Blockchain provides increased accessibility. With just an internet connection, users globally can participate in various applications without geographical barriers or restrictions on entry.

The Relationship Between Blockchain and Cryptocurrency

Blockchain technology serves as the foundational element of cryptocurrency. It is a decentralized ledger that records transactions across multiple computers, ensuring transparency and security.

Cryptocurrencies like Bitcoin and Ethereum utilize this system to verify transactions without relying on intermediaries. Each transaction is grouped into blocks, forming a chain that prevents tampering.

This relationship fosters trust among users. Since all data is publicly accessible yet secure, individuals can engage in financial exchanges with reduced risk of fraud.

Moreover, blockchain’s immutable nature enhances accountability within the crypto space. Once recorded, information cannot be altered without consensus from the network participants.

As cryptocurrencies gain popularity, understanding their link to blockchain becomes vital for potential investors and enthusiasts alike. This synergy not only underpins digital currencies but also opens up numerous possibilities for innovation in various sectors beyond finance.

Common Misconceptions about Blockchain

Many people believe that blockchain technology is synonymous with cryptocurrency. While cryptocurrencies like Bitcoin utilize blockchain, the tech itself has far broader applications. It’s a mistake to think it’s limited to digital coins.

Another misconception is that blockchain is completely anonymous. In reality, transactions are transparent and traceable on most blockchains. While user identities may be obscured, the data remains accessible for verification.

Some also argue that blockchain guarantees security against all threats. Though it offers robust encryption and decentralization, vulnerabilities can still arise from poor implementation or human error.

Some view this technology as only beneficial for large corporations. However, startups and individuals alike can leverage its capabilities for transparency, efficiency, and trust in various sectors. Understanding these nuances helps paint a clearer picture of what blockchain truly represents.

Real-World Applications of Blockchain Technology

Blockchain technology is making waves across various sectors beyond cryptocurrency. In supply chain management, it enhances transparency and traceability. Each item can be tracked from its origin to the end consumer, reducing fraud and ensuring authenticity.

Healthcare is another area benefiting significantly. Patient records can be securely stored on a blockchain, allowing authorized personnel to access crucial information instantly while maintaining privacy.

The finance sector has also embraced this innovation. Smart contracts automate transactions, minimizing intermediaries and expediting processes. This reduces costs and risks associated with traditional banking systems.

Voting systems are exploring blockchain for increased security and transparency in elections. By utilizing decentralized ledgers, tampering becomes nearly impossible, fostering trust in democratic processes.

The entertainment industry leverages blockchain for copyright protection. Artists can register their work on a secure ledger, ensuring they receive fair compensation for their creations without relying solely on middlemen.

Future Possibilities and Potential Impact of Blockchain on Various Industries

The future of blockchain technology is brimming with possibilities. One area ripe for transformation is supply chain management. With enhanced transparency, companies can track products from origin to consumer, ensuring authenticity and ethical sourcing.

Healthcare stands to benefit significantly as well. Secure patient records could be shared seamlessly across platforms while maintaining privacy and integrity. This fosters collaboration among providers without compromising sensitive data.

Financial services are also on the brink of disruption. Smart contracts could automate processes like loan approvals or insurance claims, reducing time and costs involved in transactions.

Education may see a shift too; verified credentials stored on a blockchain can simplify job applications while combating fraud.

As industries embrace this technology, innovative solutions will emerge, reshaping how we conduct business and interact globally.

Conclusion

Blockchain technology is more than just a buzzword. It represents a shift in how we think about data security, transparency, and trust.

As industries explore its potential, the possibilities seem endless. From finance to healthcare, innovative applications are emerging every day.

Adopting this technology can lead to increased efficiency and reduced costs. Businesses that embrace blockchain may find themselves at a competitive advantage.

Public perception is evolving as well. More people are beginning to understand its significance beyond cryptocurrency.

The future holds promise for enhanced collaboration between sectors and governments. This could drive us toward a more decentralized world, fostering greater privacy and control over personal information.

As we navigate this digital landscape, staying informed will be crucial. Engaging with blockchain technology today prepares us for the reality of tomorrow’s economy.

FAQs

What is blockchain technology?

Blockchain technology is a decentralized and distributed digital ledger system that records transactions across many computers. This ensures that the recorded transactions cannot be altered retroactively, providing security and transparency.

How does blockchain ensure security?

Security in blockchain comes from its use of cryptographic techniques. Each block contains a unique hash of the previous block, linking them securely. Additionally, because the data is spread across multiple nodes, it’s nearly impossible to manipulate without consensus from the network.

Can blockchain be used for purposes other than cryptocurrency?

Absolutely! While commonly associated with cryptocurrencies like Bitcoin and Ethereum, blockchain has applications in various sectors including supply chain management, healthcare, voting systems, identity verification, and more.

What are smart contracts?

Smart contracts are self-executing contracts with terms directly written into code on the blockchain. They automatically enforce agreements when predetermined conditions are met. This enhances efficiency and reduces reliance on intermediaries.

Are all blockchains public?

No. There are different types of blockchains: public (like Bitcoin), private (controlled by specific organizations), and consortium (collaborative among several organizations). Each serves different purposes based on privacy needs and access controls.

Is it possible to change information once it’s recorded on a blockchain?

Once data is entered into a public or private blockchain using proper protocols, altering it becomes exceptionally difficult without detection due to its immutable nature. However, some private blockchains may have governance structures allowing changes under specific circumstances.

What industries stand to benefit most from adopting this technology?

Industries such as finance, healthcare, logistics & supply chain management stand out as primary beneficiaries of adopting blockchain technology due to their need for increased transparency and enhanced operational efficiencies.

As you explore further into the realms of this innovative technology, consider how it could reshape processes we often take for granted today.

CRYPTO

Risk and Reward: Understanding the Volatility of Digital Asset Investments

The world of finance has witnessed a seismic shift with the rise of digital asset investments. What was once considered niche is now at the forefront of global market discussions. From cryptocurrencies to tokenized assets, these digital treasures promise not just lucrative returns but also significant risks. With prices that can soar and plummet within hours, understanding this landscape becomes crucial for any investor.

Whether you’re a seasoned trader or new to investing, navigating the volatility in this space can feel like walking a tightrope without a safety net. As opportunities abound, so too do uncertainties. Join us as we explore what makes digital asset investments both thrilling and perilous—equipping you with insights to make informed decisions in an ever-evolving marketplace.

The Importance of Understanding Volatility

Volatility is a defining characteristic of digital asset investments. It can lead to rapid price swings, which may tempt investors to act impulsively.

Understanding this volatility is crucial for anyone venturing into the digital market. Without a grasp on how prices fluctuate, investors risk making decisions based on short-term trends rather than long-term potential.

Many factors contribute to these fluctuations—market sentiment, regulatory changes, and technological advancements all play significant roles. Recognizing these influences helps in navigating the landscape more effectively.

Moreover, being aware of volatility enables better risk management. Investors can set realistic expectations and prepare strategies that align with their financial goals.

Understanding volatility not only aids in crafting informed investment strategies but also fosters emotional resilience during turbulent times across the market.

Factors That Affect the Volatility of Digital Assets

Several elements drive the volatility of digital asset investments.

Market sentiment plays a critical role. Emotional reactions to news or trends can lead to rapid price changes, often unrelated to the asset’s intrinsic value.

Regulatory developments also impact stability. New laws or guidelines can create uncertainty, causing investors to react quickly and sometimes irrationally.

Liquidity is another factor. In less liquid markets, even small trades can significantly influence prices, leading to sharp fluctuations.

Technological advancements contribute as well. Innovations like blockchain updates or new applications can shift investor confidence overnight.

Macroeconomic factors should not be overlooked. Economic indicators such as inflation rates and interest fluctuations affect overall investment behavior in all assets, including digital ones.

Risks and Rewards of Investing in Digital Assets

Investing in digital assets can be thrilling, yet it carries inherent risks. The market is known for its rapid fluctuations. Prices can soar to impressive heights overnight or plummet just as quickly. This volatility often attracts speculators looking for quick gains.

On the flip side, significant rewards exist for those who navigate these waters wisely. Early adopters of cryptocurrencies like Bitcoin saw massive returns on their investments. Such stories create allure and encourage more investors to join the fray.

However, regulatory uncertainties loom large over this sphere. Changes in legislation can impact asset values dramatically, resulting in unexpected losses.

Security issues also pose a challenge; hacks and scams are prevalent within the digital landscape. Investors need robust strategies to safeguard their holdings while remaining vigilant about potential threats.

Balancing these risks against possible rewards requires careful consideration and a sound investment strategy tailored to individual risk tolerance levels.

Strategies for Managing Volatility in Digital Asset Investments

Managing volatility in digital asset investments requires a strategic approach. One effective method is diversification. Spreading your investments across various assets can cushion against sudden market movements.

Another strategy involves setting clear risk tolerance levels. Determine how much you are willing to lose before making decisions under pressure. This clarity helps maintain focus during turbulent times.

Implementing stop-loss orders is also beneficial. These predetermined sell points act as safety nets, minimizing potential losses when prices drop unexpectedly.

Regularly reviewing and adjusting your portfolio keeps it aligned with market conditions and personal goals. Staying informed about industry trends enables quick responses to emerging risks or opportunities.

Consider dollar-cost averaging. This technique involves investing fixed amounts regularly, which reduces the impact of price fluctuations over time while building a solid investment foundation in the long run.

Case Studies: Success and Failure Stories in Digital Asset Investments

Case studies in digital asset investments reveal a spectrum of experiences. One notable success story involves Bitcoin early adopters who saw their initial investments multiply exponentially over the years. Those who embraced volatility, holding onto their assets through market downturns, often reaped significant rewards.

On the flip side, there are cautionary tales as well. Investors in failed projects like Bitconnect faced devastating losses when schemes collapsed amid regulatory scrutiny. These instances highlight how quickly fortunes can change in this sector.

Another example is Ethereum’s rise and fall during its ICO phase. Some investors made substantial gains by entering at the right time but lost much when speculation drove prices to unsustainable levels.

Such case studies underscore the unpredictable nature of digital assets and remind investors that while opportunities abound, so do risks that can lead to failure. Each experience carries valuable lessons for future investment strategies.

Conclusion: Is the Potential Reward Worth the Risk?

The world of digital asset investments is undeniably enticing. The potential for high returns attracts many investors looking to capitalize on emerging technologies and trends.

Yet, the volatility can be daunting. Price swings can happen in a matter of hours, making it essential to stay informed and agile. Missteps may lead to significant losses that overshadow potential gains.

Investors must weigh their personal risk tolerance against possible rewards. Patience, research, and strategy are crucial components for navigating this landscape effectively.

Each individual’s experience will vary based on timing, choices made, and market conditions. With the right approach, some may find it well worth the leap into this dynamic investment arena while others might prefer more stable options as they observe from the sidelines.

FAQs

What are digital asset investments?

Digital asset investments refer to assets that exist in a digital form. This includes cryptocurrencies like Bitcoin and Ethereum, NFTs (non-fungible tokens), and other blockchain-based assets. These investments have gained popularity due to their high return potential but come with significant risks.

Why is volatility important in digital asset investing?

Volatility indicates how much an investment’s value can change over time. Understanding volatility allows investors to anticipate price swings, which is crucial for making informed decisions about buying or selling assets at the right moment.

What factors contribute to the volatility of digital assets?

Several factors affect the volatility of digital assets: market sentiment, regulatory news, technological advancements, macroeconomic trends, and trading volume play pivotal roles in influencing price fluctuations.

How can I manage risk when investing in digital assets?

To manage risk effectively: diversify your portfolio among different types of assets; set strict investment limits; stay updated on market news; use stop-loss orders; and consider dollar-cost averaging as a way to mitigate entry-point timing issues.

Are there any success stories related to digital asset investments?

Yes! Many early adopters of Bitcoin saw exponential growth in their initial investments. Similarly, individuals who invested wisely in promising altcoins or innovative NFT projects have also reaped substantial benefits.

What should I be cautious about regarding failure stories in this realm?

Many investors have suffered losses due to scams or poor research into projects lacking solid fundamentals. Others faced challenges from sudden market downturns after getting caught up in hype without adequate preparation or strategy.

Is it too late to invest in digital assets now?

While some might argue that the best opportunities have passed since early adoption phases are behind us—others believe there remains untapped potential within emerging technologies and

-

HOME11 months ago

HOME11 months agoTarget Trends: What’s Hot in Stores Right Now?

-

BUSINESS11 months ago

BUSINESS11 months agoCustomer Satisfaction: Definition and Importance

-

HOME11 months ago

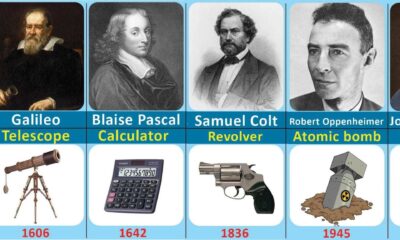

HOME11 months agoFrom Ideas to Innovations: How Inventors Change Our World

-

HOME6 months ago

HOME6 months ago300 Types of Flowers with Names from A to Z (and Pictures)

-

ENTERTAINMENT11 months ago

ENTERTAINMENT11 months agoFrom Isolation to Community: Strategies for Connecting with Readers

-

HEALTH11 months ago

HEALTH11 months agoThe Truth About Vasectomies: Myths, Facts, and Everything In Between

-

TECH10 months ago

TECH10 months agoThe Risks of Disconnecting Your AC Compressor: A Comprehensive Guide

-

HEALTH11 months ago

HEALTH11 months agoRevitalize Your Waistline: 7 Delicious Flat Stomach Detox Water Recipes for Weight Loss